ESG Glossary of Terms

A

Agenda for Sustainable Development: A declaration by the UN Political Forum on Sustainable Development issued in 2015 that sets out the 17 Sustainable Development Goals and 169 associated targets to be achieved by the year 2030 in areas of critical importance for humanity and the planet.

Air Emissions: Gases and airborne particles which are put into the air or emitted by various sources. Common air emissions of concern include Criteria Air Pollutants, Hazardous Air Pollutants, and greenhouse gasses (GHGs)

Anthropogenic: Of, relating to, or resulting from the impact or influence of human beings and human activity on nature and the environment. (See Climate Change)

Anti-Competitive Practices: Actions by an organization or its employees in collusion with others intended to limit or eliminate fair market competition. Often referred to as “Horizontal Conduct” these actions include entering into illegal or unethical agreements with competitors to such a degree that they are no longer acting independently, or when the collaboration gives the organizations the ability to wield market power together. Examples may include coordinating bids; creating market or output restrictions; fixing prices; imposing geographic quotas).

Anti-Trust and Monopoly Practice: Action of the organization that can result in barriers for entry to the sector, or another collusive action that prevents competition. Often referred to as “Single Firm Conduct”, examples of such actions can include abuse of market position, anti-competitive mergers, formation of cartels, price-fixing, unfair business practices, etc.

B

Benchmark/Benchmarking: An objective data point that serves as a reference for companies internally to target ESG performance improvements; for peers or competitors to evaluate their own performance against similar organizations within their industry, and; for investors and other stakeholders to evaluate an organization’s performance against established standards and targets.

Biodiversity: Describes the variety of life on Earth. It can be used more specifically to refer to all of the species in one region or ecosystem. Biodiversity refers to every living thing, including plants, bacteria, animals, and humans. High levels of biodiversity provide the value of maintaining a high level of variation in genomes and ecosystems—maximizing their adaptability and resilience in the face of ecological change, disease and other selective forces.

Biogenic Carbon Dioxide (CO2) Emission: Emission of CO2 from the combustion or biodegradation of biomass

Brownfield: A property or tract of land for which expansion, re-development or otherwise use may be deemed unsafe due to the presence of hazardous substances, pollutants, wastes or other contaminants.

C

Cap and Trade: An cooperative economic mechanism or framework intended to reduce GHG and other air emissions by establishing an enforceable, science-based limit (cap) on total emissions from all emitters participating in the framework, allocating emissions allowances (see carbon credit) for individual emitters/facilities based on historical emissions data, and creating a trading scheme where emitters who emit below their allowance may sell unused emissions allowances/credits to other emitters who exceed their allowances.

Carbon Credit: A generic term for any tradable certificate or permit that allows the holder (i.e. a company) participating in an emissions trading scheme to emit a specified unit of CO2 equivalents. Carbon credits are typically issued by a regulating agency which establishes a carbon credit ‘allowance’ for organizations based on historical emissions and industry averages. Unused credits can then be traded and sold between credit holders. For example, if one credit holder has emitted CO2 equivalents below their allowance, they may sell unused credit(s) to another credit holder who requires more credits beyond their allowance or face potential fees and penalties. The carbon credit trading scheme has the goal of incentivizing emissions reductions by providing real financial benefits to emissions reductions and imposing added costs for exceeding emissions allowances.

Carbon Dioxide Equivalent (CO2e): A unit to express the impact of a greenhouse gas (GHG), signified as the amount of CO2 with an equivalent impact on global warming. The amount of CO2 is commonly expressed as tonnes, also known as metric tons, equivalent to 1,000kg each.

Carbon Footprint: The amount of carbon dioxide (CO2) emissions associated with all the activities of a person or other entity (e.g., building, corporation, country, etc.). It includes direct emissions, such as those that result from fossil-fuel combustion in manufacturing, heating, and transportation, as well as emissions required to produce the electricity associated with goods and services consumed. In addition, the carbon footprint concept also often includes the emissions of other greenhouse gases, such as methane, nitrous oxide, or chlorofluorocarbons (CFCs).

Carbon Intensity: An organization’s total volume of carbon emissions for a specific process, facility, or organization as a whole, (measured in CO2e) divided by total units of production or total economic activity. Carbon intensity is an important ESG metric for evaluating the current efficiency of the organization and a targeted benchmark for future carbon emissions reductions.

Carbon Pricing: Carbon pricing is a strategy to reduce levels of greenhouse gas (GHG) emissions by associating economic costs with GHG emission levels, to incentivize companies to reduce their combustion of fossil fuels (coal, oil and gas) and reduce their GHG emissions. Carbon pricing is emerging as an accepted government policy strategy and involves either a carbon tax (a direct tax levied based on emissions) or carbon emission trading (CAT), aka “cap and trade.”

Carbon Neutral: For a project or entity to be carbon neutral, any CO2 released into the atmosphere is balanced by an equivalent amount being removed. This may be achieved through financing or otherwise supporting efforts to remove CO2 from the atmosphere, such as the development of renewable energy projects or planting trees or using carbon credits or carbon trading schemes. An entity may therefore be ‘carbon neutral’ without reducing its emissions.

Carbon Offset: A carbon offset is a mechanism by which an entity compensates for greenhouse gas (GHG) emissions by paying for an equivalent GHG reduction, such as the development of renewable energy projects or planting trees.

CDP (formerly Carbon Disclosure Project): The CDP (formerly the Carbon Disclosure Project) is an international non-profit organization based in the United Kingdom, Japan, India, China, Germany, and the United States of America that supports companies and municipalities in their efforts to measure and manage their environmental risks and opportunities, including those related to climate change, water security and deforestation.

Circular Economy (CE): The concept of the circular economy is a central, modern approach to sustainability and ESG. In a linear economy, companies use raw materials to produce goods that are assumed to reach an “end of life.” They become waste, and companies continually just produce new goods to replace them. In a CE, by contrast, the goal is to reuse, refurbish and recycle to create a closed loop system to the highest degree possible.

Climate Change: The long-term change in the average weather patterns that characterize Earth’s local, regional, and global climates. These changes have a broad range of observed effects that are synonymous with the term. Within the scope of ESG, we are focused on the anthropogenic effects of climate change.

Climate Risks and Opportunities: The phrase “climate risks and opportunities” is common in the ESG world and refers to both the urgency to avoid negative consequences associated with climate change, and the opportunities available for businesses who shift their business model to provide sustainable products and services increasingly demanded by stakeholders. For example, climate risks would include risks of contributing to global greenhouse gas emissions that drive additional climate change, and of risks to business continuity posed by extreme weather events that are becoming more frequent due to climate change. Opportunities would include the manufacturing of products that replace more emissions-intensive products and services and capturing the growing market demand for such products.

Climate Transition Plan: A climate transition plan is a formal written plan describing how an organization will pivot its existing assets, operations, and business model to account for climate risks and opportunities, and to align with specific climate recommendations and science-based targets, such as reaching net-zero by 2050 to mitigate climate change.

Conscious Consumerism: Consumers actively seeking out and purchasing products and services they perceive to be produced responsibly.

Conscious Capitalism: A form of capitalism that seeks to benefit people and the environment (see triple bottom line).

Corporate Social Responsibility (CSR): A management concept that integrates social and environmental concerns into business operations and stakeholder relationships. CSR is generally understood as the set of organizational values through which a company achieves a balance of economic/financial, environmental and social imperatives (See Triple-Bottom-Line) while also addressing the expectations and interests of stakeholders.

Corporate Sustainability Reporting Directive (CSRD): The Corporate Sustainability Reporting Directive (CSRD) is a binding agreement issued by the European Council in 2022 that amends the 2014 non-financial reporting directive to address shortcomings in the disclosure of non-financial information, which was of insufficient quality to allow it to be properly taken into account by investors. CSRD introduces more detailed reporting requirements and ensures that large companies are required to report on sustainability issues such as environmental rights, social rights, human rights and governance factors. The CSRD also introduces a certification requirement for sustainability reporting as well as improved accessibility of information, by requiring its publication in a dedicated section of company management reports. The European Financial Reporting Advisory Group (EFRAG) is responsible for establishing European standards of compliance with the CSRD.

Corporate Governance: The policies, practices, and processes used to direct and manage a company. The main force influencing corporate governance is a company’s board of directors, although the board is strongly influenced by stakeholder interests and priorities.

Cradle-to-Grave: The concept that hazardous substances and wastes which have long-term or permanent harmful effects to human health and the environment should be managed in a manner that minimizes or eliminates those effects from the point of origin to final disposal, and at each point of transfer or storage throughout the management life cycle.

D

Divestment: The act of dissociating or selling assets and securities due to behavior not aligned with ESG values, or a way to display strong commitment to ESG and responsible investing practices.

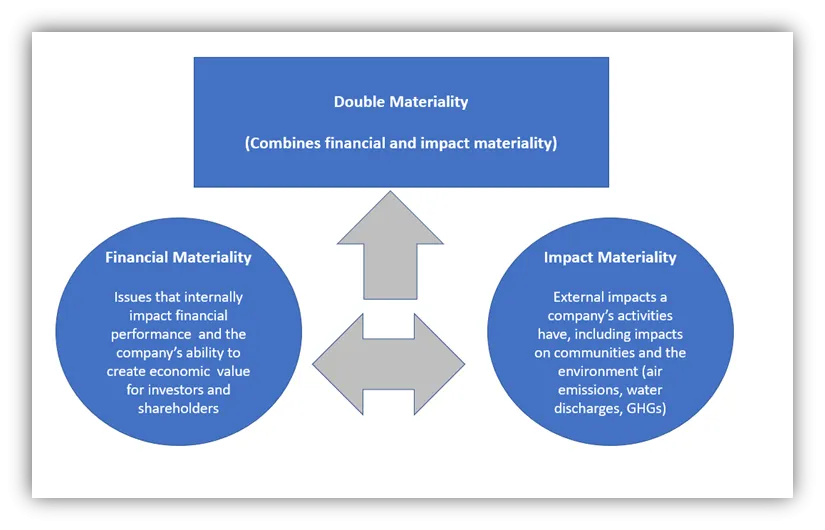

Double Materiality: Double materiality is a perspective for determining the ESG issues that matter most to an organization that recognizes the relevance and interconnectedness of both Impact and Financial Materiality. Put another way, double materiality is the union of impact and financial materiality; a company would consider an ESG issue material if they determine it to be material from either an impact or financial materiality perspective. The draft European Sustainability Reporting Standards (ESRS) recently published by the European Financial Reporting Advisory Group (EFRAG) would create mandatory disclosure requirements for tens of thousands of European companies based on a double materiality framework.

Dow Jones Sustainability Indices (DJSI): A group of corporate listings provided for sustainability-focused investors to identify companies who have demonstrated sufficiently sustainable business practices and ESG performance. DJSI indices serve as benchmarks for investors who integrate sustainability considerations into their portfolios, and also provide an effective engagement platform for investors who wish to encourage companies to improve their corporate sustainability practices.

Dynamic Materiality: Dynamic Materiality recognizes that what is considered material may change over time, and therefore takes a forward-looking, adaptive approach to reprioritizing ESG topics to allow for more regular action on newly identified risks.

E

EcoVadis: A third-party sustainability consultancy and ratings firm which works with businesses to assess ESG risks and develop strategies and policies for organizations to achieve greater levels of ESG performance. Visit https://ecovadis.com/about-us/

Emissions Inventory: A measure of the total greenhouse gas emissions produced by an individual, group, or company.

Energy Star: Energy Star is program run by the U.S. Environmental Protection Agency and the U.S. Department of Energy. According to the program’s official website, Energy Star is intended to provide simple, credible, and unbiased information that consumers and businesses rely on to make well-informed decisions regarding a company or product’s energy efficiency.

Environmental Aspects & Impacts: An “aspects and impacts” analysis is an exercise in identifying the characteristics (aspects) of an organization’s operations that create significant environmental issues (impacts) such as waste generation, water discharges, or air emissions, including GHG emissions. For instance, ISO 14001, the international standard for environmental management systems, states that organizations need to determine the “internal” and “external” issues relevant to its environmental performance and determine which “aspects” of their operations have significant environmental “impacts.” The process of conducting an aspects & impacts analysis therefore involves many of the same considerations as doing a Materiality Assessment and should involve the same stakeholders.

Environmental Management System (EMS): According to ISO 14001, the international standard for environmental management, an environmental management system is a “set of interrelated or interacting elements of an organization to establish policies and objectives,” and includes “the organization’s structure, roles and responsibilities, planning and operation, performance evaluation and improvement.” A simple way to think of an EMS is as “people, places, and programs.” It consists of all the people who play roles in your EMS, including employees as well as external stakeholders like contractors and regulators, the facilities involved in your operations, and the specific environmental programs and policies for your organization. An important thing to remember is therefore that EMSs are as unique as the organizations developing and using them. They’re not “one size fits all,” and no one can sell you an EMS. Tools such as good EHS & ESG software can help you manage an EMS but are not the EMS itself.

Environmental, Social and Governance (ESG): ESG is an acronym for a business management approach that actively pursues excellence across three core areas of performance: environmental, social and governance. Performance in these core areas is evaluated using ESG metrics established under various ESG reporting standards and frameworks, and this data is heavily relied upon by sustainability-focused investors to evaluate and select companies and other investments for their portfolios. Examples of what ESG factors cover vary but they can include climate change, worker health and safety, DEI, human rights, labor rights, corporate ethics, business transparency and protecting the interests of shareholders.

EPA Waste Reduction Model (WARM): EPA’s WARM is intended to show generators of hazardous waste the connection between better waste management practices and reduction of associated greenhouse gas (GHG) emissions. The model provides high-level estimates of potential greenhouse gas (GHG) emissions reductions, energy savings, and economic impacts from several different waste management practices. Waste management practices considered under WARM include source reduction, recycling, anaerobic digestion, combustion, composting and landfilling. Companies pursuing ESG maturity that generate significant volumes of hazardous waste would find WARM potentially useful for reducing their GHG footprint.

Ergonomics: The process of designing jobs and workstations to fit the worker, with the goal of reducing or eliminating risk for musculoskeletal disorders (MSDs) and other ergonomics-related injuries, and maximizing the number of workers who are able to safely perform a given job.

ESG Audit: Objective testing and verification of an organization’s ESG policies, systems, performance claims and other ESG program aspects. ESG audits are typically performed by a third-party auditor or consultancy that is independent of that organization in order to establish an impartial assessment of the organization’s ESG management and provide confidence for investors and other stakeholders in their decision-making processes.

ESG Disclosure: Reporting of environmental, social, and corporate governance data for the purpose of providing stakeholders with information on a company’s ESG performance and activities. ESG disclosure is the primary means of communicating to stakeholders that the company is meeting ESG targets and goals, and that the company’s commitment to ESG is genuine and not engaging in greenwashing. ESG disclosure is often performed in alignment with one or more ESG standards or reporting frameworks, and is a primary source of data for investors, supply chain partners and other stakeholders’ decision-making processes.

ESG Benchmarking: ESG benchmarking is a process of assessing some aspect of an organization’s ESG performance against the performance of comparable peers. For example, if you’re evaluating the energy efficiency of a facility, you’d want to compare it against the energy efficiency of other buildings with similar size, location, and asset type (i.e., residential, office building, retail, etc.). Benchmarking can play an important role in understanding your ESG performance and identifying areas for improvement.

ESG Integration: A process that combines the organization’s environmental, social and governance risks and priorities together with the typical financial and operational risks and goals of the business, and considers the effects and impacts that these risks and goals have on the business in a holistic fashion.

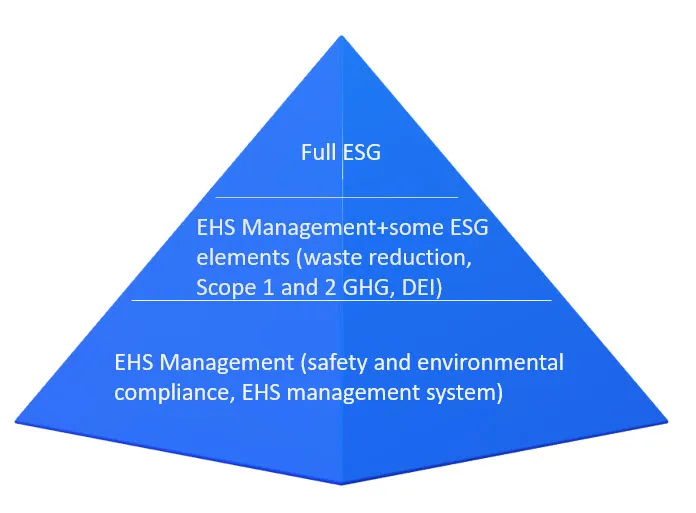

ESG Pyramid: The ESG pyramid is a visual representation of the stages in ESG maturity, loosely based on Abraham Maslow’s pyramid depicting the hierarchy of needs. The pyramid, shown below, conveys the idea that good EHS management is the foundation for achieving and maintaining ESG maturity. Organizations should consider using tools, including cloud-based software, that help with the full range of their EHS & ESG tasks to ensure better continuity of management practices and a firmer foundation om which to build mature ESG programs.

ESG Ratings: A measurable way to gain an understanding of a company’s performance and long-term commitment to environmental, social, governance (ESG). These ratings can be derived from evaluation criteria set forth in various ESG reporting standards and frameworks, or by third-party sustainability/ESG ratings organizations. These ratings are commonly relied on by organizations internally to benchmark their own performance and formulate improvements in ESG performance, and by sustainability-focused investors as a basis for evaluating risk and investment potential.

ESG Strategy: The term “ESG strategy” describes the process of an organization establishing primary ESG goals, measurable targets, and plans for achieving those goals. Ideally, this process would follow completion of a Materiality Assessment to identify the most important ESG issues for the organization and help ensure the company’s efforts are focused on the right things. A system of Objectives, Targets and Programs is one tool organizations can use as part of their ESG strategy.

Ethical Investing: Choosing investments that avoid companies who produce or deal in products and services that may be considered harmful or misaligned with sustainable business practices and values.

European Financial Reporting Advisory Group (EFRAG): EFRAG is a private organization founded by request and with the encouragement of the European Commission in 2001 to provide technical expertise and guidance on financial and accounting matters. In that capacity, they worked closely with the International Financial Reporting Standards (IFRS ®) Foundation, who themselves had recently formed in 2000.

Through its advisory relationship with IFRS, EFRAG influences the International Accounting Standards Board (IASB), a group operating under the authority of IFRS which develops and approves its parent organization’s accounting and financial standards. For example, EFRAG is a member of the European delegation to the IASB Accounting Standards Advisory Forum (ASAF), and the CEO of EFRAG is a member of the IFRS Advisory Council.

In 2022, EFRAG published a number of draft standards that would require tens of thousands of European companies to provide disclosures in various areas of ESG, including GHG emissions, how the organization considers climate risks and opportunities, air and water pollution, and workers in the value chain.

European Green Deal: The European Union’s (EU) Green Deal is the EU’s stated growth strategy to transition the EU economy to a sustainable economic model. It sets out the goal of making the EU climate neutral by 2050 by reshaping the EU economy in the areas of climate impacts, energy, sustainable industry, building efficiency, transport, pollution, agriculture, biodiversity, research and development, and economic trade.

F

Financial Materiality: Financial materiality is one perspective for determining the ESG issues that matter most to an organization. It uses the lens of economic value-creation – it’s focused on the issues that internally impact a company’s financial performance and its ability to create economic value for investors and shareholders. This is the definition of materiality adopted by the International Sustainability Standards Board (ISSB), an organization formed by its parent entity, the International Financial Reporting Standards (IFRS) Foundation, in late 2021.

G

GHG Protocol: The GHG Protocol is a standards development body that establishes comprehensive global standardized frameworks to measure and manage greenhouse gas (GHG) emissions from private and public sector operations, value chains and mitigation actions. The GHG Protocol issued the first edition of its first standard, the Corporate Accounting and Reporting Standard, in 2001 and revised it in 2004. Over the years, the GHG Protocol has also published other standards related to various aspects of GHG accounting.

Global Reporting Initiative (GRI): GRI (Global Reporting Initiative) is an independent, international organization headquartered in Amsterdam, the Netherlands that helps businesses and other organizations with widely used standards for sustainability reporting – the GRI Standards.

Green Bond: A green bond is a bond (i.e., a fixed income financial asset) that is used to fund projects that have positive impacts on the environment or climate.

Green Chemistry: Green chemistry is the design of chemical products and processes that reduce or eliminate the use or generation of hazardous substances. Green chemistry applies across the life cycle of a chemical product, including its design, manufacture, use, and ultimate disposal.

Greenhouse Gas (GHG): A GHG is a gas that absorbs and emits radiant energy within the thermal infrared range, causing the greenhouse effect. The primary greenhouse gases in Earth’s atmosphere are water vapor (H2O), carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), and ozone (O3). Because of the scientifically established role of GHGs in causing climate risks, all major ESG disclosure frameworks involve tracking and reporting GHG emissions.

Green Taxonomy: Also known as the EU Taxonomy, is a classification system which establishes a list of environmentally sustainable economic activities under the European Green Deal. The Green Taxonomy gives companies, investors, policymakers, and other stakeholders with standardized definitions for which economic activities can be considered environmentally sustainable. The intended effect is to provide certainty for stakeholders in evaluating ESG performance of organizations while helping those organizations to benchmark and improve their own performance more effectively.

Greenwashing: “Greenwashing” is a general term referring to efforts by organizations to frame themselves as having higher ESG maturity than they have. Greenwashing can come in several forms, including simple use of rhetoric or marketing claims not backed up by actions, “creative accounting” practices that make ESG initiatives seem more successful than warranted, or “sleight of hand” to, for example, present themselves as reducing GHG emissions when they’ve really just shifted their emissions from Scope 1 to Scope 2 or Scope 3 emissions. Concerns about greenwashing are one of the driving forces behind the push for better and more consistent ESG metrics, which has resulted in the formation of the International Sustainability Standards Board (ISSB) and the publication of its first draft standards.

GRESB (formerly Global Real Estate Sustainability Benchmark): GRESB is an organization established in 2009 that provides standardized and validated ESG data from the real estate sector to investors and capital markets. Companies in the real estate and property management sectors frequently use GRESB data for ESG Benchmarking to assess the sustainability performance of their global real estate and infrastructure investments.

H

Human Capital: “Human capital” is a common term referring to the economic and organizational value of the workforce’s experience, skills, and contributions to success of the company. The term generally includes assets like education, training, intelligence, skills, health, and engagement and participation in company initiatives, including EHS & ESG programs. Management of human capital is an important part of ESG maturity, and should include considerations of psychosocial risks, Diversity Equity and Inclusion (DEI), and general equity in compensation and career opportunities.

I

IFRS Foundation: The IFRS Foundation is a not-for-profit, public interest organization established to develop high-quality, understandable, enforceable and globally accepted accounting and sustainability disclosure standards.

Impact Materiality: Impact materiality is a perspective for determining the ESG issues that matter most to an organization. Impact materiality focuses on the external impacts an organization’s activities have, including impacts on communities and the environment. According to the European Financial Reporting Advisory Group (EFRAG), “a sustainability matter is material from an impact perspective if it is connected to actual or potential significant impacts by the undertaking on people or the environment over the short-, medium- or long-term. This includes impacts directly caused or contributed to by the undertaking in its own operations, products or services and impacts which are otherwise directly linked to the undertaking’s upstream and downstream value chain, and not limited to contractual relationships.”

Intergovernmental Panel on Climate Change (IPCC): The IPCC is an intergovernmental body of the United Nations (UN) headquartered in Geneva, Switzerland. IPCC is responsible for advancing knowledge on climate change and its human sources, including industrial activities. The World Meteorological Organization (WMO) and the United Nations Environment Programme (UNEP) established IPCC in 1988.

Integrated Reporting: An approach to corporate reporting that integrates financial information and non-financial (e.g. ESG disclosure) information into a single document to show how a company is performing.

International Sustainability Standards Board (ISSB): The ISSB is a group within and overseen by the IFRS which is tasked with developing a comprehensive and standardized global base of sustainability-related disclosure standards to provide investors and other stakeholders with information about companies’ ESG risks and opportunities to help them make informed and reliable data-driven decisions.

ISO 14001: ISO 14001 is an international standard developed by the International Organization for Standardization (ISO) that models best practices for an environmental management system (EMS). ISO published the first edition of 14001 in 1996 and revised the standard in 2004 and 2015. The most recent (2015) edition reflects the increasing consensus about the importance of considering all stakeholders (both internal and external to the organization) and the larger context of the company’s operations, both of which are integral considerations for ESG management.

An organization can choose to certify to ISO 14001, in which case they will need to undergo audits by an accredited third-party organization to confirm that they are aligned with the framework of 14001 as well as in alignment with their own programs and policies in their EMS. ISO 14001 is a useful framework for companies pursuing ESG maturity, because it helps them develop good processes to complete basic environmental management tasks and maintain regulatory compliance while adding sustainability initiatives. EHS management is the base of the ESG Pyramid, and a necessary foundation for ESG maturity.

ISO 26000: ISO 26000:2010 is a non-binding guidance standard developed by the International Standards Organization (ISO) that is designed to clarify and standardize definitions and criteria of ‘social responsibility’. This guidance helps businesses and organizations translate often abstract principles of social responsibility into concrete actions and best practices to improve social responsibility. ISO 26000 is increasingly accepted as viable criteria for assessing an organization’s commitment to social sustainability and ESG performance.

ISO 45001: ISO 45001 is an international standard published by the International Organization for Standardization (ISO) in 2018 that models best practices for occupational health & safety (OH & S) management systems (SMSs). Compared with previous standards for OH &S management like OHSAS 18001, 45001 has a greater emphasis on identification and consideration of internal and external stakeholders, and on “consultation and participation” of all workers, including non-managerial workers. These characteristics align 45001 with the growing consensus of global OH & S subject matter experts about the importance of engagement and worker buy-in to safety management programs, and the emphasis on stakeholders’ points toward ESG Strategies.

An organization can choose to certify to ISO 45001, in which case they will need to undergo audits by an accredited third-party organization to confirm that they are aligned with the framework of 45001 as well as in alignment with their own programs and policies in their SMS. Because 45001 takes a broad view of the organization and its context, and recognizes the need to address a wide range of risks and opportunities, it provides a good framework for addressing the ”S” in ESG and pursuing ESG maturity.

ISO 45003: ISO 45003, titled “Occupational health and safety management — Psychological health and safety at work — Guidelines for managing psychosocial risks” is a guidance standard published by the International Organization for Standardization (ISO) in 2021. The standard is not intended to be used for certification purposes in itself but is intended to supplement and work in tandem with ISO 45001 to help an organization manage Psychosocial Risks within its OH &S management system. ISO’s development and intended use of the standard reflects the growing consensus among EHS & ESG experts that psychosocial risks management depends on traditional safety management.

J

K

Kyoto Protocol: the Kyoto Protocol functionally implements the United Nations Framework Convention on Climate Change by committing industrialized nations and economies to limit and reduce greenhouse gas (GHG) emissions to agreed individual targets established in the Convention, to adopt reduction policies and measures, and to report progress on emissions reductions periodically.

The Kyoto Protocol only binds developed countries who signed on to the Protocol due to their disproportionate role in contributing to increasing levels of GHG emissions in the atmosphere. Annex B of the Kyoto Protocol sets binding emission reduction targets for 37 industrialized countries and economies in transition and the European Union.

L

Leadership in Energy and Environmental Design (LEED): A widely used global standard developed by the US Green Building Project (USGBC) to certify new or existing buildings for efficient use of energy and other resources. Because it’s easier and more cost-effective to design a building sustainably to begin with than to retrofit sustainability into it later, Prevention through Design is an important aspect of pursuing LEED certification.

Life Cycle Assessment (LCA): The process of attempting to measure the environmental impacts of a product or service throughout its existence.

M

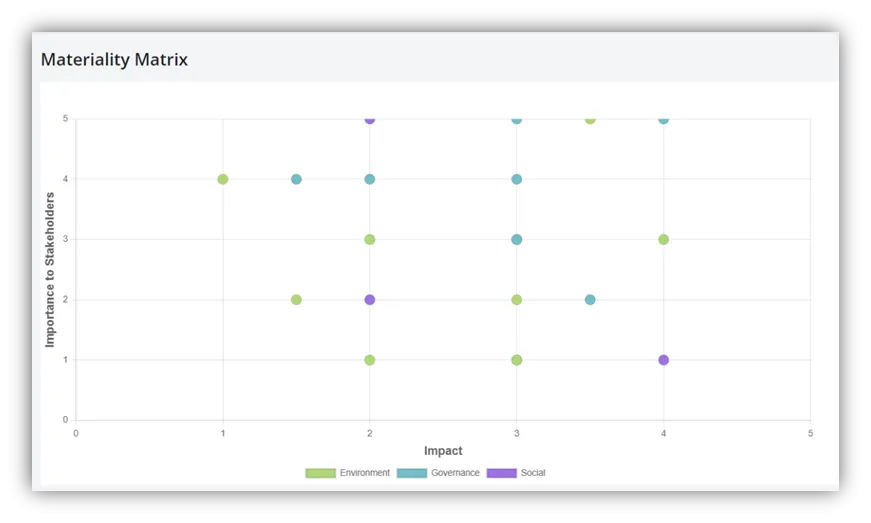

Materiality: Materiality is a measure of the importance of specific ESG issues to a company and its stakeholders. There are several main frameworks for determining importance, including impact materiality, financial materiality, and double materiality. A company would determine materiality via a Materiality Assessment and can usefully summarize the findings with a Materiality Matrix.

Materiality Assessment: A materiality assessment is a survey on specific ESG topics distributed to stakeholders, for purposes of identifying the most significant ESG issues facing the company. Conducting a materiality assessment is an important step in ESG management, because it helps ensure that companies are prioritizing their time and money on the right goals, and that all internal and external stakeholders are engaged and aligned with those goals.

Materiality Matrix: A materiality matrix is a visual tool for displaying and prioritizing the results of a Materiality Assessment. The y-axis plots importance, and the x-axis plots impact. ESG issues that have the largest product of importance and impact will wind up in the top right quadrant, just like in a risk matrix. All your stakeholders can then quickly recognize the issues requiring the most attention. A sample materiality matrix is shown in the image below. The intuitive visual organization of a materiality matrix makes it an ideal preparatory tool for planning ESG Strategy.

N

Natural Capital: The world’s stock of natural resource ‘assets’ including geology, soil, air, water and all living things.

Net Zero: The term “net zero” describes a greenhouse gas (GHG) management strategy to reduce overall levels of GHGs to the point where remaining levels of GHG emissions to the atmosphere are exactly balanced by the amount of GHGs removed from the atmosphere, for a “net” of zero emissions.

O

Objectives, Targets & Programs: A set of “objectives, targets, & programs” is a common strategy for managing environmental and sustainability projects, especially for organizations following or certified to ISO 14001, the international standard for Environmental Management Systems. Objectives are goals, stated generally, that you would like to meet in the future. In other words, when you’re writing an objective, even though you should already be thinking about how you’re going to measure and verify them, you’re not going to get that granular yet.

Targets are the point where granularity comes in. Setting targets involves determining specific verifiable measures to document that you’re meeting your objectives and meeting the chosen performance criteria. Programs are the specific methods and strategies you’re going to use within your environmental management system to achieve your objectives and targets.

An organization selects its Objectives, Targets and Programs based on its assessment of material impacts. For example, an organization that has a facility that annually uses a significant amount of natural gas for comfort heating would want to develop an objective to reduce natural gas consumption. A target might be to reduce natural gas usage by 10% relative to a baseline, and a program might involve replacement of boiler insulation to improve boiler efficiency.

P

Paris Agreement: The Paris Agreement is an international treaty on climate change negotiated by 196 parties at the 2015 United Nations Climate Change Conference held near Paris, France and adopted in 2015. The agreement covers climate change mitigation, adaptation, and finance. The Paris Agreement’s long-term temperature goal is to contain the rise in mean global temperature to below 2 °C (3.6 °F) above pre-industrial levels, and preferably limit the increase to 1.5 °C (2.7 °F), to substantially reduce the effects of climate change. Many long-term ESG strategies by municipalities and companies reference and align with the goals of the Paris Agreement.

Prevention Through Design: Prevention Through Design (Ptd) is a program administered by the National Institute of Occupational Safety and Health (NIOSH) to prevent or reduce occupational injuries, illnesses, and fatalities through the inclusion of prevention considerations in all designs that impact workers. According to the program’s website, methods of accomplishing this include:

- a) eliminating hazards and reducing risks to workers to an acceptable level “at the source” or as early as possible in the life cycle of items or workplaces;

Including design, redesign and retrofit of new and existing work premises, structures, tools, facilities, equipment, machinery, products, substances, work processes and the organization of work.

Enhancing the work environment through the inclusion of prevention methods in all designs that impact workers and others on the premises

While some EHS professionals recognize the importance of PtD principles for improving occupational health and safety, PtD is also an important element of ESG maturity. For example, it can help ensure that factors such as energy efficiency and water conservation are considered in the design phase of new operations or facilities.

Product Stewardship: Product stewardship is the process managing products or materials in a way that reduces their impact on the environment and human health throughout their lifecycle. Some of the considerations involved in product stewardship include ingredients used and looking for opportunities to substitute less hazardous ingredients that pose less risk to employees or end users and are less likely to pose environmental risks down the line, such as through off-gassing or disposal or treatment as hazardous wastes.

Psychosocial Risks: Psychosocial risks are aspects of work or the workplace itself that produce anxiety for workers, and associated health risks such as hypertension as a result of the anxiety. The key takeaway is that problems with traditional safety management, such as failure to involve employees in safety activities or to properly identify and control risks, can lead employees to have anxiety, i.e. to psychosocial risks. As such, a focus on psychosocial risks is an important part of getting the “S” in ESG right. International Organization for Standardization (ISO) has developed a guidance standard, ISO 45003, designed to work with its standard for occupational health & safety (OH & S), ISO 45001, which reinforces the point that better safety management requires identification and control of all risks related to the workplace. A company pursuing ESG maturity will need to go beyond regulatory compliance and take a broad view of risks and opportunities, including psychosocial risks.

Q

R

Remediation: Environmental clean-up, treatment and other engineering measures designed to reverse or mitigate the impacts of environmental releases of hazardous substances and wastes and other industrial activities to waters and lands.

Renewable Energy: Energy sources that are not depleted by use. Examples include energy from the sun, wind, and small (low-impact) hydropower, plus geothermal energy and wave and tidal systems.

S

SASB: See Sustainability Accounting Standards Board (SASB) glossary term.

Science Based Targets: Science-based targets provide a roadmap for companies to future-proof growth by creating a roadmap of how much to reduce carbon emissions and how quickly the reduction needs to happen.

Science Based Targets Initiative: Science-based targets provide a clearly defined pathway for companies to reduce greenhouse gas (GHG) emissions. Targets are considered ‘science-based’ if they are in line with what the latest climate science deems necessary to meet the goals of the Paris Agreement – limiting global warming to well-below 2°C above pre-industrial levels and pursuing efforts to limit warming to 1.5°C.

Scope 1 GHGs: Direct greenhouse gas emissions from sources owned or controlled by a business, such as emissions from fossil fuels burned on site. For example, electricity generated on site by burning of fossil fuels is measured as Scope 1 emissions associated with that fossil fuel.

Scope 2 GHGs: Indirect greenhouse gas emissions associated with the generation of purchased electricity or other energy through a utility provider for consumption by the business

Scope 3 GHGs: Emissions generated by activities from assets not directly owned or controlled by the business, but by organizations which are indirectly linked to the business within its value chain. Scope 3 emissions include all sources not within an organization’s scope 1 and 2 emissions. For example, the GHG emissions generated by a producer of a raw material used within a business’ production processes.

Securities and Exchange Commission (SEC): The US federal government agency which oversees securities exchanges, securities brokers and dealers, investment advisors, and mutual funds to promote fair dealing, the disclosure of important market information, and to prevent fraud. In 2022, the SEC published a proposed rule which would require may US-based investment advisers, advisers exempt from registration, registered investment companies, and business development companies to provide more specific disclosures in fund prospectuses, annual reports, and adviser brochures based on the ESG strategies they pursue.

Sham Recycling: Sham recycling refers to activities that a waste generator or manager intentionally or unintentionally misrepresents as recycling. EPA has created a page to help distinguish legitimate recycling from sham recycling and note that the latter “may include situations when a secondary material is Ineffective or only marginally effective for the claimed use; used in excess of the amount necessary; or handled in a manner inconsistent with its use as a raw material or commercial product substitute.” Companies looking to pursue ESG maturity need to identify and avoid sham recycling to achieve their goals.

Social Capital: The intrinsic value of social networks including the relationships and shared values in society that enable different and diverse individuals and groups to successfully work together.

Social Enterprise: Businesses that operate with the primary mission to tackle social problems, improve communities or the environment.

Sustainability Disclosure Requirements (SDR): Developed by the United Kingdom’s Financial Conduct Authority (FCA) and issued in January 2022, the SDR implements and modifies requirements for companies already covered under the FCA to report on their sustainability risks, opportunities, and impacts. The SDR builds on steps already taken by the FCA to implement disclosure rules aligned with the recommendations of the Taskforce on Climate-related Financial Disclosures (TCFD) to account for ESG topics beyond climate change. SDR disclosure requirements will be aligned with the forthcoming EU Green Taxonomy and global baseline sustainability reporting standards to be developed by the International Financial Reporting Standards (IFRS) Foundation’s International Sustainability Standards Board (ISSB).

Sustainability Accounting Standards Board (SASB): SASB is a non-profit organization that develops standards and reporting frameworks that guide the disclosure of financially material sustainability information by companies to their investors. SASB standards are available for 77 industries, each identifying a unique subset of environmental, social, and governance issues most relevant to financial performance in each industry. In August 2022, the Value Reporting Foundation which oversaw SASB was consolidated into the IFRS Foundation which also oversees the ISSB.

Sustainable Design: Designing products, services, and the built environment in keeping with principles of sustainability.

Sustainable Finance Disclosure Regulation (SFDR): SFDR is an EU regulation aimed at improving market transparency for sustainable investment products, preventing greenwashing, and provide objective verification of sustainability claims made by financial market participants. It creates sustainability disclosure requirements covering a broad range of environmental, social & governance (ESG) metrics and went into force March 10, 2021. The SFDR is a core component of the EU Sustainable Finance Agenda.

Stakeholder: A stakeholder is a party internal or external to the organization who affects, or is affected by, the company’s EHS & ESG performance. The concept of a stakeholder has expanded with the growing importance of ESG to include investors, regulatory bodies and non-governmental organizations (NGOs), value chain partners, contractors and others. Identification of stakeholders is a crucial step in conducting an ESG Materiality Assessment.

Stakeholder Capitalism: Stakeholder capitalism is a term reflecting the growing awareness that companies have responsibilities to a range of stakeholders besides just shareholders and employees, including external stakeholders such as communities. This is an increasingly important idea in ESG management that coincides with the concepts of Double Materiality and the Triple Bottom Line.

Supply Chain: A supply chain is the system of organizations, people, activities, information and resources involved in moving a product or service from point of origin to point of use. Supply chain management is an important consideration in ESG management, and increasingly includes due diligence on whether various supply chain partners are using sustainable and ethical business practices, including use of equitable labor practices, protection of customer rights, and reduction of waste generation and GHG emissions. Supply chains are the foundation of value chains because, without them, companies cannot provide customers with the products and services they want, when they want then, and at fair and competitive prices.

T

Task Force on Climate Related Financial Disclosures (TCFD): A working group established in 2017 by the Financial Stability Board (FSB) to develop recommendations on the types of ESG information that companies should disclose to support investors, lenders, and insurance underwriters in appropriately assessing and pricing risks related to climate change.

Total Worker Health ®: A program developed by the CDCs National Institute for Occupational Safety and Health (NIOSH) that describes policies, programs, and practices to help employers integrate workplace hazard reductions, work-related injury and illness prevention, and labor-related factors such as wages, work hours, workplace condition and culture as a means of improving overall worker health, satisfaction and well-being. The Total Worker Health (TWH) approach seeks to improve the well-being of the U.S. workforce by protecting their safety and enhancing their health and productivity.

Triple Bottom Line: The term “triple bottom line” refers to the idea that companies have an ethical obligation, a business incentive, and increasing stakeholder expectations to find the right balance between “profits,” “people” and “the planet.” That is, corporate leaders need to expand from a focus on making profits and increasing shareholder value to a focus that also includes equitable treatment of employees and workers in the value chain and stewardship of the environment. The concept aligns with the concepts of Double Materiality and Stakeholder Capitalism.

U

UN Framework Convention on Climate Change (UNFCC): The UN Framework Convention on Climate Change developed an international treaty signed by 154 states at the United Nations Conference on Environment and Development (UNCED), informally known as the “Earth Summit,” held in Rio de Janeiro in June 1992. The treaty went into effect in March 1994 and calls for continuing scientific research and policy development to understand and address the causes of climate change.

UN Global Compact (UNGC): UNGC is a non-binding pact developed and promoted by the UN to encourage organizations around the world to adopt sustainable and socially responsible policies, and to report on their implementation.

United Nations Climate Change Conference: The UN Climate Change Conference is an annual conference held by the United Nations Framework Convention on Climate Change, and serves as a formal meeting of the conference of the UNFCCC parties, also known as the Conference of the Parties, or COP. Over the years, the Conference has resulted in some of the most significant developments in the world of ESG, including adoption of the Kyoto Protocol in 1997, and the formation of the ISSB in 2021.

UN Sustainable Development Goals (SDGs): A set of 17 “Global Goals” and 169 associated targets adopted by 193 member countries of the United Nations (UN). The purpose of the SDGs is to encourage and guide global efforts to eradicate poverty, end hunger and address climate change by 2030. SDGs are an important framework for municipalities as well as individual public or private companies as they develop their ESG goals and programs.

UN Principles for Responsible Investments (PRI): The Principles for Responsible Investment were developed via a process convened by the UN Secretary-General by an international group of institutional investors to reflect the increasing relevance of environmental, social and corporate governance issues to investment practices.

UN Guiding Principles Reporting Framework (UNGPRF): The UNGPRF is a reporting guidance framework launched by the UN is 2015 to help organizations more accurately and transparently report on their management of human rights issues. The framework guides corporations via series of questions intended to prompt consideration and disclosure of human rights policies, processes and performance.

Utility Data Integration: A data management strategy for utility data, such as energy consumption, in which ESG software interfaces with the utility provider to directly capture the associated utility usage data. Utility data integration offers companies pursuing ESG distinct advantages, such as no longer needing to look for, request, and manually enter data from utility bills, avoiding administrative errors in entering the data, using the correct emission factors, and automatically converting the units on the utility bills to the specific units tracked by the company.

V

Value Chain: The term “value chain,” in simplest terms, just refers to the process through which a company adds value to a product, including during production, transportation, marketing and the provision of after-sales service. As such, the value chain builds upon the supply chain. Value chain considerations are very important for ESG maturity, as stakeholders increasingly demand more equitable treatment of workers throughout the value chain, whether they are upstream or downstream of the company’s operations. For example, European Financial Reporting Advisory Group (EFRAG) has published a draft standard on Workers in the Value Chain which, which would require tens of thousands of European companies to track and share information related to value chain workers, including its policies regarding “risks and opportunities related to value chain workers.”

Value Reporting Framework (VRF): The VRF is a sustainability standards development organization that has played a significant role in the consolidation of ESG reporting frameworks. VRF brought together the Integrated Reporting Framework and the Sustainability Accounting Standards Board (SASB) standards under common administration. As of August 2022, VRF has consolidated with the International Financial Reporting Standards (IFRS) Foundation to support the efforts of the International Sustainability Standards Board (ISSB) to consolidate ESG disclosure frameworks and improve the reliability and accuracy of ESG metrics shared by organizations.

W

Waste Diversion: A management strategy that disposes of waste through methods other than incineration or landfilling/disposal. Examples include reuse and recycling.

X

Y

Z

Zero Carbon: A operation or process where all industrial sources of CO2 have been converted to run on zero carbon emitting energy sources (renewable energy) so that no carbon emissions are being added to the atmosphere.

Zero Waste: Zero waste is a term used to describe efforts to produce goods more sustainably. The Zero Waste International Alliance (ZWIA) defines it as “the conservation of all resources by means of responsible production, consumption, reuse, and recovery of products, packaging, and materials without burning and with no discharges to land, water, or air that threaten the environment or human health.” The principle of Zero Waste is therefore about more than just reducing the amount of material discarded as waste and is more broadly about examining the entire lifecycle of a product or material to identify and correct inefficiencies and unsustainable production and consumption practices.