The United States Securities & Exchange Commission (SEC) recently published a proposed rule that would expand and enhance disclosure requirements pertaining to Environmental, Social, and Governance (ESG) and climate-related risks for public companies. While many businesses have long anticipated such a move by the SEC, many companies have greeted the news with reactions ranging from apprehension to curiosity, and many stakeholders are looking for more information about the proposed rule and what they can expect to happen next. This blog has the information they want.

In this piece, we’ll review the specific proposed changes and the potential timeline for them, and provide some key takeaways.

Background of the SEC’s Proposed ESG Disclosure Rule

ESG has been gaining importance in recent years as data has come in revealing that companies with higher ESG maturity also have better financial performance. For example, a 2020 Harvard study found ESG performance to correlate with economic value added (EVA) margin, which is the incremental difference in the rate of return (RoR) over a company’s cost of capital. What that means in plain English is that companies with higher levels of ESG maturity see a better return on their investments than companies with lower ESG maturity.

Increasingly, financial institutions and venture capitalists have also been using ESG performance as a lens through which to screen potential investments for risks that traditional financial disclosures might not identify. That’s because better ESG performance is not only associated with greater profitability, but also with avoidance of the kind of significant events (e.g. fires, chemical spills, explosions) that can threaten employee health and well-being, disrupt business and cause major drops in share price. The same 2020 Harvard study mentioned above found that companies with the highest level of ESG performance had the lowest amount of volatility in business performance.

The SEC first began providing investors with information about environmental management risks for public companies in the 1970s, and published guidance in 2010 on disclosure requirements related to climate change. As that last point shows, the SEC’s requirement for some companies to provide at least some ESG-related disclosures is not new. But until recently, the SEC’s guidance resulted in a fairly limited view of what climate risks were material to the organization, and more limited corresponding requirements for reporting and disclosure.

Because ESG has become such an important predictor of a business’s financial health, it was inevitable that the SEC would start paying more attention and expand its disclosure requirements. Indicators of that attention came in February 2021, when the commission began a review of its guidance for public company obligations for disclosures related to climate change risk. The SEC also created a special task force in March 2021 to help verify that organizations already making ESG disclosures were doing so with accuracy. In July 2021, the SEC chair, Gary Gensler, stated that the SEC had begun working on a proposed rule for mandatory climate-risk reporting, and at that time anticipated that a rule may materialize before the end of the year. While that timeline didn’t hold up, as 2021 ended, most business leaders who’d been tracking trends related to ESG and the SEC’s stated intentions suspected that the commission would soon take action by issuing a proposed rule.

What is the SEC Proposing?

The SEC’s new proposed rule, published on March 21, makes good on the commission’s efforts to expand ESG-related disclosure requirements for public companies registered with the SEC. A screen capture of part of the first page of the final rule is shown below.

Here is some of the major information that the proposed rule would require public companies registered with the SEC to disclose:

- Their governance of climate-related risks and relevant risk management processes;

- How those climate-related risks identified by the company have had or are likely to have material impact on its business and financial performance, whether over the short-, medium-, or long-term;

- How the identified climate-related risks have affected or are likely to affect the registrant’s strategy, business model, and outlook;

- The impact of climate-related events (such as severe weather events and other natural conditions) on specific line items within the company’s consolidated financial statements, as well as on the financial estimates and assumptions they use in those statements;

- Whether the company has adopted a climate transition plan as part of its climate risk management strategy. A climate transition plan describes the company’s specific greenhouse gas (GHG) emission reduction goals, and how they will pivot their operations and business model to achieve those goals. The SEC proposal would require companies to describe the plan and the metrics and targets used to identify and manage their climate-related risks, including projected financial impacts associated with their efforts, and their potential failure to achieve goals.

- The company’s direct GHG emissions (Scope 1), indirect GHG emissions from purchased utility energy sources (Scope 2), and indirect GHG emissions from upstream or downstream value stream partners whose GHG emissions are influenced by the company’s operations, aka Scope 3 emissions, if material or if the company has set GHG emissions targets that include Scope 3 emissions. An example of a Scope 3 emissions source would be the GHG emissions associated with treatment of a company’s wastes by a third party Treatment, Storage, and Disposal Facility (TSDF). According to the GHG protocol, there are 15 categories of Scope 3 emissions. It’s worth noting that historically, many companies have had difficulties identifying, tracking, and reporting Scope 3 GHG emissions.

Public companies registered with the SEC would need to include the information above on its registration statements and periodic reports, such as on Form 10-K.

You can read the entire SEC proposed rule here. The SEC has also produced a fact sheet summarizing the main elements of their proposal.

The SEC notes that the proposed rule is intended to help companies more efficiently manage their climate-related risks, and that the proposed disclosures are similar to those many companies already provide through widely recognized reporting frameworks such as the Task Force on Climate-Related Financial Disclosures (TCFD) and the Greenhouse Gas Protocol (GGP).

“I am pleased to support today’s proposal because, if adopted, it would provide investors with consistent, comparable, and decision-useful information for making their investment decisions, and it would provide consistent and clear reporting obligations for issuers,” said the SEC Chair, Gary Gensler, in a press release about the proposed rule.

Timelines for the SEC’s Proposed ESG Changes

So far, we’ve seen what the SEC is proposing. Let’s get into the when details now and discuss what we know about timing.

The first thing we need to realize is that there’s a public comment period, which according to the SEC’s press release, will “remain open for 30 days after publication in the Federal Register, or 60 days after the date of issuance and publication on sec.gov, whichever period is longer.” And then, we hit the biggest wildcard in the timeline, which is how long it will take the SEC to sort through all the comments and decide whether or to what extent to modify its proposals before issuing a final rule. Because we can probably expect a great deal of stakeholder feedback, it’s hard to say how long it will take the SEC to develop and publish a final rule.

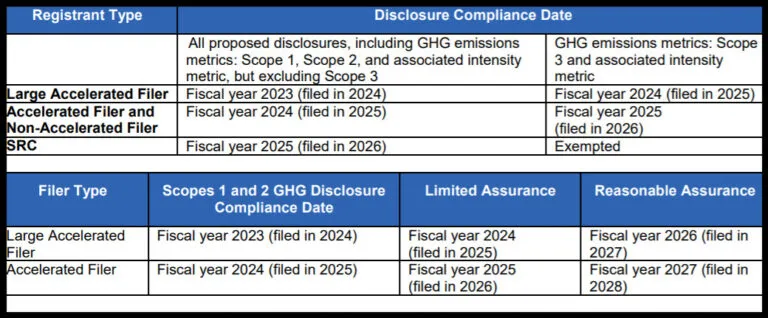

Once the final rule does appear, we’ll be into a far more predictable part of the timeline. The proposed rule includes a phase-in period, along with exemptions. The chart below from the SEC’s fact sheet summarizes the proposed timeline.

Note that there are a few key assumptions in the table above. The first is that the final rulemaking will be adopted with a December 2022 effective date – as already noted, we’ll just have to wait and see when the final rule does appear. Another assumption is that the company reporting their ESG information has a December 31st end to their fiscal year, which is not always the case. And perhaps the biggest assumption is that the proposed timeline will not change itself in the process of the SEC developing its final rule.

Nonetheless, there will be a definite timeline once the final rule appears, and companies affected by the proposed changes would do well to assume that the phase-in timeline won’t be longer than what we see summarized above. That means they’d benefit from taking actions today to prepare to report the required ESG information.

Key Takeaways on the SEC’s Proposed ESG Disclosure Rule

If you have a public company, you’ll need to start preparing to meet the proposed SEC disclosure requirements. But keep in mind that even if you have a private company, you’re competing against public companies who will need to meet these new requirements, in a marketplace that increasingly expects ESG disclosures from businesses. Therefore, while the takeaways below mostly apply to public companies, all companies should give them strong consideration.

Get organized. Some companies may already be conducting an internal analysis of their GHG emissions and their materiality to business or may have publicly announced GHG reduction goals. If so, they’d have a good foundation to build on to facilitate public sharing of metrics and details they already track internally. But if you haven’t yet started getting a handle on ESG generally and GHG emissions specifically, there’s no time like the present.

Improve your GHG management game. Many organizations struggle to report all of their GHG emissions, especially those from Scope 3 sources. Modern climate solutions can simplify this task by providing a common platform for tracking all three scopes of GHGs and aligning your reporting with common disclosure frameworks.

Expect more focus on ESG. This is arguably the biggest takeaway of all. More stakeholders, including regulators, investors, and members of the general public, are demanding accountability and transparency when it comes to ESG. The SEC itself may continue to expand its concept of materiality and its disclosure requirements as time goes on.

Additional Information on ESG Management

If you’re looking for more information on ESG, we’ve got you covered.

To learn why ESG isn’t just something for big companies to be thinking about, check out our blog, “Five Amazing Benefits of ESG for Companies of Any Size.”

If you need more information on how to track all three scopes of GHG emissions, download our guide, “Tracking All Three Scopes of Greenhouse Gas with ESG Software.”

Our on-demand webinar, “ESG – What You Need to Know Now” provides a broad overview of what ESG is and how businesses can successfully navigate the journey from traditional EHS management to ESG maturity. A good companion piece to that is our blog, “Have You Mastered the ESG Pyramid?” which lays out why ESG builds upon and depends upon a solid foundation of good EHS management.

Finally, please be sure to follow us on Linkedin so you can keep up with more updates about the worlds of EHS and ESG, and the ways we can help you become safer and more sustainable.

Let VelocityEHS Help!

VelocityEHS Climate is just the tool you need to improve your energy management and your tracking of GHG emissions. Powerful utility data integration capabilities ensure you’ll be able to capture all your energy data, easily convert it to the units you need, and identify trends in energy usage. We also provide a single platform for tracking all three scopes of GHG emissions, with reporting capabilities aligned with major ESG disclosure frameworks.

ESG is here to stay, so get the tools you need in place today to achieve and maintain ESG maturity. Request a demo or contact us today to learn more about how we can support your continuing ESG journey.