By Phil Molé, MPH

California has become the first US state to issue ESG disclosure requirements. While many EHS and ESG managers and company leaders may be understandably focused on disclosure regulations emerging at the national level, California’s ESG disclosure rules are a reminder that anyone managing their company’s ESG governance needs to be aware of and prepared for state requirements, as well.

This blog breaks down California’s ESG disclosure rules and provides some major takeaways for EHS professionals.

What Do California’s ESG Disclosure Rules Require?

California Governor Gavin Newsom signed the ESG disclosure rules in October 2023.There are two separate ESG disclosure rules, with requirements breaking down as follows:

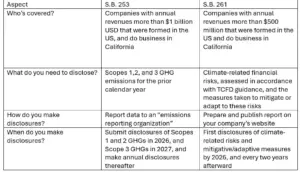

1) SB 253, the “Climate Corporate Data Accountability Act,” requires some companies to disclose all three scopes of their greenhouse gas (/GHG) emissions. The term “scopes” describes the sources of GHG emissions relative to a company’s operations, based on definitions and guidelines established the GHG Protocol, an organization that publishes accounting guidelines that organizations around the world use to identify and track their GHG emissions inventory. Scope 1 GHGs are those directly emitted by a company’s operations, Scope 2 GHGs are indirect emissions associated with purchased utility energy, and Scope 3 emissions are associated with the company’s value chain, from sources either upstream or downstream of the company’s operations. SB 253 states that organizations required to disclose their GHG emissions must submit their reports to a nonprofit emissions reporting organization contracted by the California Air Resources Board (CARB). Further details about the specific organizations that will receive and manage these reports will likely follow as the compliance timelines get closer.

S.B. 253 applies to companies doing business in California that generate annual revenues of more than $1 billion. The rule itself does not provide details on the specifics of making disclosures, designating CARB to develop and issue implementation regulations, and stipulating that CARB must issue these regulations on or before January 1, 2025. The rule also authorizes enforcement mechanisms for CARB, including penalties for non-filing, late filings, or other failures to meet disclosure requirements.

2) SB 261, “The Climate-Related Financial Risk Act,” will require certain companies to disclose climate-related financial risks in accordance with Task Force on Climate-Related Financial Disclosures (TCFD) guidelines published in 2017. Affected companies will also need to disclose the measures they’re taking to mitigate or adapt to identified climate-related financial risks. SB 261 stipulates that companies subject to these disclosure requirements will need to provide the disclosures in a report made publicly available on the company’s website. If for any reason a company subject to SB 261 is unable to provide the required information, they would need to report what they can to the best of their ability, explain the reasons for any gaps, and describe the steps they will take to fully comply. Note that although TCFD disbanded as an organization in late 2023, TCFD guidance remains widely in use, as the referencing of TCFD framework within SB 261 shows. The International Sustainability Standards Board (ISSB) now oversees implementation of TCFD guidance and encourages its continued use by organizations for identification of climate risks and opportunities.

One unresolved question at this point is whether SB 261 specifically requires covered companies to conduct scenario analysis or to disclose if they’ve conducted one. Scenario analysis is a specific type of climate-based risk assessment exercise that involves considering how different consequences, or scenarios related to climate change could potentially impact a company’s revenues and business resilience. For example, climate change brings physical risks, such as extreme weather events that could either directly damage the company’s facilities or interrupt supply chains, as well as marketplace risks, such as shifts in customer preferences toward higher energy efficiency or cleaner energy-using products. While the words “scenario analysis” don’t appear in the text of SB 261, the 2017 TCFD guidance referenced in the bill as the basis companies should use for assessing climate risks does reference scenario analysis as a preferred climate risk assessment method. This is another area where more specific implementation guidance is expected.

SB 261 applies to companies formed in the US that do business in California and generate annual revenues greater than $500 million.

It should be noted that the text of both bills states that they apply to companies “doing business in California” without defining what exactly it means, but since a Senate Floor Analysis Memo for SB 253 references the California Revenue and Tax Code, we can infer that the definition there is probably the one that applies here. The Revenue and Tax Code defines “doing business in California” as “actively engaging in any transaction for the purpose of financial or pecuniary gain or profit” in California; being “organized or commercially domiciled” in California; or having California sales, property or payroll exceeding specified amounts. As we move closer to the implementation timeframe, the state of California may issue additional clarifications and guidance. The chart below summarizes some of the major details about the two bills.

When Do California’s ESG Disclosure Requirements Go into Effect?

Companies subject to SB 253 would need to disclose Scopes 1 and 2 GHG emissions by 2026, and obtain limited assurance for their data, and provide reasonable assurance by 2030. Affected companies would need to start disclosing their Scope 3 GHG emissions by 2027 and obtain limited assurance for Scope 3 disclosures by 2030.

Those companies subject to SB 261 would need to provide their first disclosures by 2026 and would need to provide the disclosures every two years thereafter.

Of course, it is still possible that California will push out the compliance timeline, revise requirements, or at the very least, publish clarifications or implementation guidelines. For example, in his signing statement for SB 253, Governor Newsom states that, “the implementation deadlines in this bill are likely infeasible, and the reporting protocol specified could result in inconsistent reporting across businesses subject to the measure.” The statement also notes that Governor Newsom’s administration would be working with the bill’s author and the California state legislature during 2024 to address these issues. Even so, it’s safe to assume that the requirements themselves are staying in place, and businesses affected by these two California climate disclosure rules will need to start preparing now.

Will Other States Be Drafting ESG Disclosure Requirements?

The short answer is “probably.” As of this writing, other states are considering regulations similar to California’s ESG disclosure rules, including Illinois and Washington. While no bills have been signed yet in other states, there are indeed already rulemakings in their early stages in other states.

For example, an Illinois state representative has proposed a Climate Corporate Accountability Act (HB 4268), which would require US companies that generate over $1 billion in annual revenue and do business in Illinois to disclose Scopes 1-3 GHG emissions as defined by the GHG Protocol standards. As written, the bill would require affected companies to disclose Scopes 1 and 2 GHGs by January 1, 2025, and Scope 3 GHGs within an additional 180 days. If Illinois passes this law, the Secretary of State will adopt reporting and verification rules by July 2024 and contract with an emissions registry provider to establish an internet disclosure platform by January 2025. Finally, companies required to make disclosures must verify their emissions through an emissions registry or third-party auditor.

Judging by the example of California’s ESG disclosure rules and the subsequent discussion of them, these deadlines may be too ambitious, and subsequent clarifications or revisions of these proposed requirements may be necessary as the bill continues its journey toward being signed into law, if in fact it does. But also judging by California’s example, there’s a good chance that some version of these requirements will go into effect, not only in Illinois but in other states.

What are the Main Takeaways About California’s ESG Disclosure Requirements?

There are many moving parts to California’s ESG disclosure rules, as well as to the world of GHG disclosures generally. Here are some key takeaways.

Climate disclosure requirements are here to stay. You may be hearing and reading a lot about pushbacks on ESG or the idea that ESG is “going away,” but the growing number of global regulations requiring ESG disclosures tells a different story. For example, the Corporate Sustainability Reporting Directive (CSRD) is now in effect and requires tens of thousands of EU and EU-listed companies to prepare ESG disclosures based on the European Sustainability Reporting Standards (ESRSs) developed by European Financial Reporting Advisory Group (EFRAG). In the United States, Securities and Exchange Commission (SEC) has recently announced the finalization of its disclosure rules for publicly listed companies, which require those companies to report details of their management of climate risks and opportunities.

The point here is that climate disclosure regulations are becoming more of a thing, not less of a thing. You should probably accept that GHG disclosures are here to stay and recognize that a commonality across these regulations is the mandate for companies to assess relevant climate risks and to disclose GHG emissions.

Even if these requirements don’t apply to you, pressure to provide climate disclosures is increasing. Your company may not be subject to the California disclosure rules, or any of the other existing or forthcoming disclosure requirements discussed in this article, but that doesn’t mean they won’t affect you. For one thing, one or more of your value chain partners may be subject to these requirements, and if so, they will need your company to document and provide climate-related data so that they can meet their disclosure requirements. For another, potential investors in your business and financial institutions you may approach for business loans will likely want to see documentation of your ESG governance when making decisions. Finally, you can’t discount the preferences of your customers and prospects, who increasingly are using evidence of corporate ESG performance to decide which businesses to support.

Companies will need to prioritize collecting and reporting good GHG data. Because of the increasing number of disclosure requirements and increasing pressure from many fronts, company leaders should start collecting GHG data, or improve their existing processes. Many businesses lack efficient processes for collecting and managing data, especially for Scope 2 and Scope 3 GHGs. Scope 2 GHG tracking requires an efficient and accurate method of collecting data from their utility companies, which can be difficult if you’re still working with paper copies or manually performing emission factor calculations. Tracking of Scope 3 GHGs poses even more problems because the sources are downstream or upstream of your operations.

Of course, you’ll also need to organize your data into the right format to meet reporting requirements. It is possible that a company could be subject to more than one regulation and would need to meet the requirements of several distinct, if overlapping, disclosure regulations—e.g., a US public company that does business above applicable thresholds in California and EU could need to prepare disclosures in accordance with SEC, California and CSRD requirements. Luckily, the types of reporting required under all these regulations are broadly similar and are also similar to the disclosures under voluntary frameworks such as Global Reporting Initiative (GRI), ISSB, and the Sustainability Accounting Standards Board (SASB) standards currently overseen by ISSB.

Let VelocityEHS Help!

Are you looking for help collecting and reporting GHG emissions data? Now is the perfect time to reassess the systems and technology tools your organization relies on to collect, analyze, and report climate risk information to regulators, investors, and other stakeholders to reduce risks of non-compliance and boost the confidence of your value chain partners, investors and customers in your ESG governance.

The GHG & Energy Management capabilities in the VelocityEHS ESG Solution allow you to automate and simplify the collection, validation, and reporting of your utility energy data. You can choose and apply the correct emissions factors from an updating library and perform correct unit conversions eliminating much of the administrative burden and potential error associated with manual data management. You’ll also have out-of-the-box reporting capabilities aligned with major disclosure frameworks but flexible enough to meet shifting or emerging disclosure requirements with the investor-grade data you need to demonstrate compliance to satisfy investor and value-chain partner information requests.

Don’t wait to get your climate risk disclosure data in order. Request a Demo today and see firsthand how Velocity can put your organization on a firm footing for compliance.