By Phil Molé, MPH

Over the last several years, we’ve seen Environmental, Social and Governance (ESG) move from the background to the foreground of the business world. Still, there have been some bumps in the road. Lately, we’re seeing some public cases of resistance, even hostility, toward ESG. And many individual business leaders, facing more difficult economic times, may be concluding that their pursuit of ESG maturity must wait.

In what follows, we’ll review some of the headwinds facing ESG initiatives, but also look at some of the main factors that in our view, predict a long future ahead for ESG. Most of all, we’ll make the case that ESG is no longer a “nice to have,” it’s a “must have.”

Has ESG’s Momentum Slowed Down?

This is a fair question, because if you’ve been following the news, you’ve most likely come across some high-profile examples of pushback against ESG.

For example, the government of Florida recently passed a resolution prohibiting consideration of “social, political and ideological interests” including ESG performance in the process of making decisions for investments in the $186 billion state pension fund. Florida Governor Ron DeSantis has stated his intent to work with the state legislature to codify the resolution into law, and that he’d ordered the state’s pension fund to invest with the goal of “maximizing financial return over and above other considerations.” We’ll look at the assumption that ESG considerations have no bearing on financial performance or investment decisions later in this piece.

There’s been evidence of pushback in the US in the halls of federal government, as well. A senior member of the Senate Banking Committee recently urged banks to stop following an “ESG agenda that harms America,” and to stop basing financial decisions on purportedly non-financial ESG considerations. The assumption of “harm” seems to depend on the assumption that there’s a bright line between ESG issues and financial issues that business managers and investors should be primarily focused on.

Undoubtedly adding to the “is this trip really necessary?” sentiment about ESG is economic uncertainty, driven in part by the rate of inflation, which has been at multiyear highs due to factors such as supply chain disruptions. The Federal Reserve’s response, involving graduated raising of interest rates, has made securing loans more expensive for businesses, which may lead to putting off investments in ESG programs perceived as “nice to haves” rather than “must haves.” Anxiety about falling revenues or the potential impacts of recession only add to the perception that now might not be a good time to be thinking about ESG.

Is ESG “On the Way Out?”

We can see that there are some challenges facing ESG right now. Do they mean that ESG is on the way out as a widely adopted management approach?

The short answer is “no.”

You’re still reading, so we’ll assume you’re curious about the long answer. It starts something like this: While there may be more areas of pushback, as discussed above, there are several reasons why ESG is likely going to continue to be an important management framework for years to come. Let’s look at each of these reasons.

Mandatory ESG Reporting Frameworks

One of the most important factors influencing the long-term importance of ESG pertains to existing or proposed mandatory reporting frameworks. While ESG disclosures were largely voluntary several years ago, that’s in the process of changing.

In the US, the Securities and Exchange Commission (SEC) published a proposed rule in 2022 that would require publicly traded companies registered with the SEC to disclose details such as their governance of climate-related risks and relevant risk management processes, how the identified risks are likely to affect their business, and their emissions of Scopes 1,2, and 3 (if material) GHG emissions as defined by the GHG Protocol. Check out this past blog post for more details on the SEC proposal.

When we talked about the SEC proposed rule on a LinkedIn Live event earlier this year, some commenters expressed consternation, stating that the SEC “overreached” because they saw such disclosures as unconnected to business or share value. We’ll talk more about the connection between ESG and financial performance soon, but for now, it’s important to recognize that the SEC had already required ESG-related disclosures from some companies for many years, if they considered it financially relevant. The current proposed rule expands the number of companies that would be required to report as well as the scope of reporting, but it does so based on years of deliberations that an expanded scope was needed to meet the needs of investors. That’s why the proposed rule would require public companies registered with the SEC to include the information above on its regular registration statements and periodic reports, such as on Form 10-K.

Even if some representatives of US companies are hoping the SEC never comes out with a final rule and this proposal just “goes away,” they should remember that the US isn’t the only country, and other governments are also pursuing mandatory ESG disclosure frameworks. For example, as we previously blogged about, the European Financial Reporting Advisory Group (EFRAG) published its first batch of draft standards in 2022, addressing many different facets of ESG. The draft rules will significantly expand the number of European companies required to provide sustainability disclosures to over 50,000 from around 12,000 currently, introduce more detailed reporting requirements, and require audited assurance of the information reported.

Consolidation of ESG Reporting Frameworks

Another indication that ESG is buckling in for the long haul is that ESG reporting frameworks, which had proliferated quickly during the early phase of ESG’s ascendance, are now consolidating. The formation of the International Sustainability Standards Board (ISSB) by the International Financial Reporting Standards (IFRS) Foundation late in 2021 happened in response to growing stakeholder demand for a consistent and reliable ESG metrics modeled on a small number of established frameworks. This is the kind of thing that only happens when stakeholders are convinced that ESG has a future and want disclosure frameworks that help bring it there.

The ISSB has already had a busy year in 2022. As we’ve discussed in an earlier blog post, they published their first two draft standards on March 31, 2022. The ISSB is also directly fostering consolidation through absorption of other standards and standards-setting bodies into their organization. The Value Reporting Foundation, which had brought together the Sustainability Accounting Standards Board (SASB) and the Integrated Reporting Framework, has now fully consolidated into the IFRS Foundation. This means that oversight of the SASB standards has shifted to the ISSB. Additionally, according to an IFRS Foundation press release, The IFRS Foundation’s International Accounting Standards Board (IASB) and the ISSB share responsibility for the Integrated Reporting Framework, and jointly working on plans to build on and integrate the Integrated Reporting Framework into their standard-setting projects and requirements.

Established Links Between ESG Performance and Profitability

One of the major reasons ESG isn’t likely going away is largely the same reason behind its widespread adoption in the first place: the evidence connecting higher ESG performance with better business performance. It just isn’t tenable to separate ESG issues from bottom-line issues.

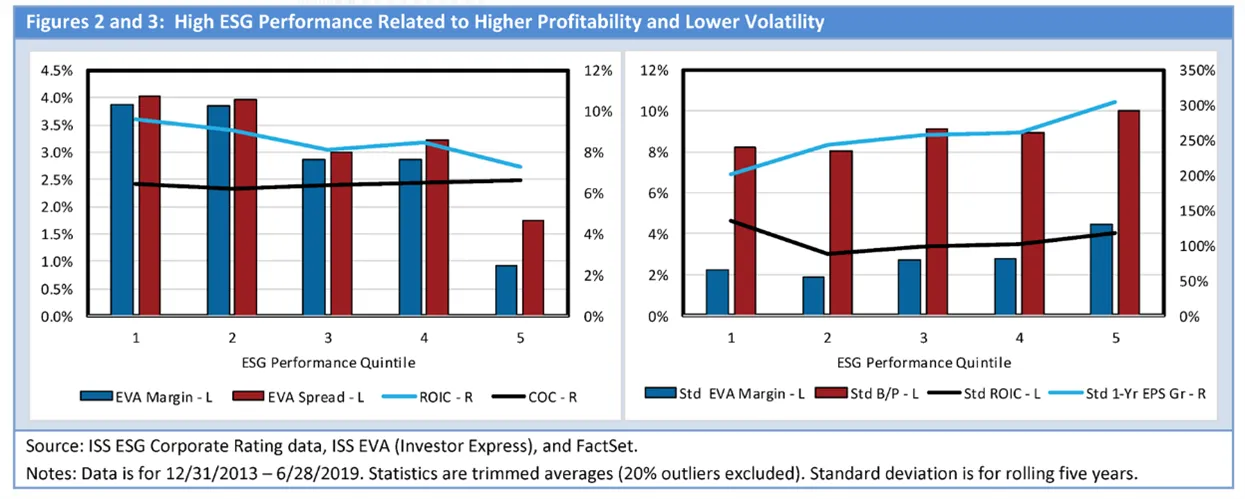

The charts below summarize key findings of a 2020 Harvard study on the relationships between ESG maturity, profitability and business volatility. The chart on the left shows that the higher a company’s ESG performance is (represented by the lowest numbers on the x-axis), the higher its economic value added (EVA) margin, which is a measure of profitability. In the chart on the right, we see that high ESG performance also tracks with reduced volatility, as defined by major business disruptions or loss of a majority of shareholder value.

It’s not hard to understand why these relationships exist. A company that successfully builds ESG maturity becomes more efficient, e.g., by reducing utility energy usage and costs associated with management and treatment of wastes, and that reduced spend means increased profitability. Companies with higher ESG maturity also not only have their house in order when it comes to basic compliance with EHS regulations, but also have probably taken a broad approach to managing their risks and opportunities. Consequently, they’re much less likely to have catastrophic events such as major chemical spills that can disrupt business and cause losses of investor confidence.

These are all compelling reasons why ESG is going to remain a major business management focus, as well as a framework for how various stakeholders perceive the business. Consumers and individual investors demonstrate this through the “divest movement” – “divest” is the opposite of “invest,” and it’s what people will do if they see evidence that you’re not committed to ESG. Venture capitalists and financial institutions also use ESG as a filter to screen potential investments for risks not evident from balance sheets alone, and that’s not going to change.

Introducing ESG QuickTakes: A Sustainability E-Newsletter!

Master ESG with our NEW quarterly publication. Get expert insights on regulations, energy management, and sustainability delivered straight to your inbox.

ESG and Business Agility

It’s been an intense few years, with stresses coming from all directions. Many businesses that weren’t agile enough to adapt through this time are no longer in business. On the other hand, companies that have developed ESG maturity have done the work to comprehensively scope out the risks and opportunities facing their business, which as the 2020 Harvard study discussed earlier shows, reduces their vulnerability to accidents or other unplanned events that could disrupt operations. They’ve reduced operating costs, which (let’s be clear) is even more important in times of inflation. Those businesses also have built good stakeholder relationships and are collecting and reviewing performance metrics – all of which improves their ability to pivot at the right times.

When understood in this light, it’s no surprise that it was during the height of the global pandemic – the very time that we might’ve expected businesses to ignore ESG and just focus on the “bottom line,” that ESG gained the most ground. According to a 2021 industry survey:

- 89% of CEOs wanted to ‘lock in’ their sustainability and climate change gains;

- 96% said their response to the pandemic shifted their focus to the social component of ESG, an increase from 63% compared to August 2020; and

- 83% stated that they re-evaluated their purpose because of COVID-19 to better address stakeholder needs, up from 79% as measured in August 2020.

The executives in this survey understand that ESG is a roadmap for the transformations they must make to meet core business challenges. There may be a subset of business leaders who insist that ESG has nothing to do with traditional business and insist even more loudly the more evidence they see to the contrary. But there are also many business leaders who understand the connection very well, and because of that, their companies are more likely to successfully navigate future challenges.

ESG is a “Must Have,” Not a “Nice to Have”

While some business leaders may still think of ESG as something purely voluntary, aspirational, and unimportant to “real” business, that assessment has never been farther from the mark. Notwithstanding a few well-publicized cases of resistance to ESG in news cycles, the larger story is that ESG is crystalizing into a permanent approach to managing business. There is going to be more mandatory ESG reporting, and internal and external stakeholders have already accepted the importance of ESG.

ESG is no longer a “nice to have.” It is a “must have.”

As Jan Erik Saugestad, chief executive of Storebrand Asset Management put it, “ESG factors are not just ‘nice to have’ but drivers of outperformance. It is both right and smart to exclude certain business practices in violation with well recognized conventions or with inherent high risk and negative impact.”

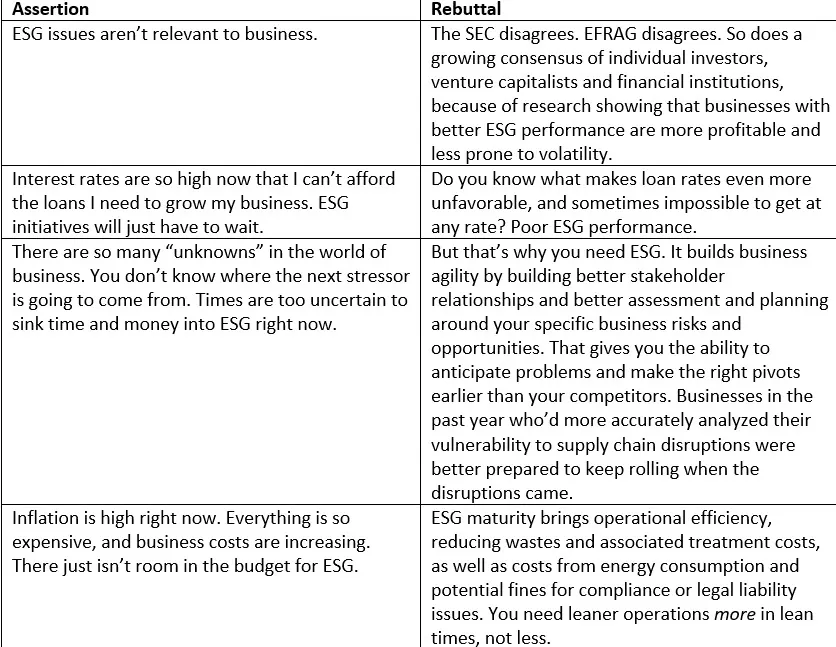

There are still some pretty common assertions that ESG isn’t central to business or doesn’t require attention now, but all of those assertions have rebuttals, as shown in the table below.

Companies that don’t focus enough on ESG risk losing the support of employees, losing customers, losing advantages for securing investments, losing operational efficiencies, and losing supply chain partners. And once you’ve lost market ground to businesses that have taken ESG seriously, there’s no getting it back. On the other hand, when you build ESG maturity, you build resilience, because you’re doing a better job assessing and acting on your risks and opportunities.

You might feel overwhelmed by the thought of tackling ESG on top of your existing EHS and business responsibilities, and that’s OK. You’re not alone, because many businesses are still navigating the long journey to ESG maturity, often while shoring up their basic EHS management effectiveness. In fact, in a poll we conducted during a recent webinar, only 5% of attendees rated themselves as having a “robust, mature ESG program,” and nearly half (48.6%) admitted to being mostly focused on regulatory compliance.

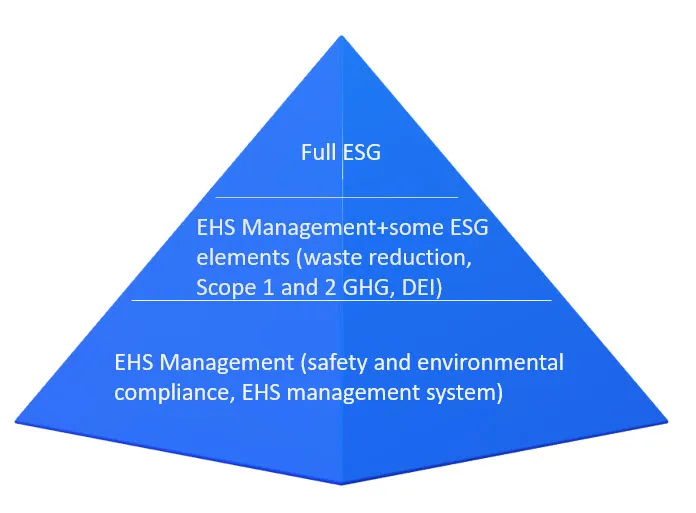

The opportunity to build and leverage ESG is there, but have realistic expectations, because every company’s starting point is different, and you’ll need to plan the journey that makes sense to you and proceed at a logical pace. And there’s no escaping the fact that to do ESG well, you need to have a solid foundation in EHS management, as the ESG Pyramid image below shows.

The good news is that modern EHS & ESG software can help by making it easy to share responsibility for EHS tasks and collect and share data. And when you’re ready to start building ESG maturity, you can get help with conducting materiality assessments to identify your highest priority issues, sharing the results with stakeholders, and developing company specific ESG strategies.

The one thing you can’t do is put off beginning your ESG journey. The best time to have begun was yesterday, but the second-best time is today. Don’t sleep on it, because your competitors won’t be waiting.

Let VelocityEHS Help!

Our ESG Software, part of our VelocityEHS Accelerate ® Platform, provides exactly the support you need. Track all three scopes of your GHG emissions, with reporting capabilities aligned with major ESG disclosure frameworks. Materiality assessment capabilities within the software also help you easily generate surveys you can share with stakeholders, so you be sure you’re identifying easier to miss issues such as categories of Scope 3 GHGs.

ESG is here to stay, so get the tools you need in place today to achieve and maintain ESG maturity. Request a demo or contact us today to learn more about how we can support your continuing ESG journey.