If you’ve been following the growing dominance of ESG as a management framework, you’ve probably seen or heard references to the concept of materiality. If you’ve been following closely, you may have already encountered references to the concept of double materiality. While these terms are important for organizations to understand, it can be tricky to determine precisely what they mean—and more importantly, how you can use them to achieve and maintain greater ESG maturity.

In what follows, we’ll break down the concepts of “materiality” and “double materiality” and share some key takeaways about their importance to ESG management.

Introducing ESG QuickTakes: A Sustainability E-Newsletter!

Master ESG with our NEW quarterly publication. Get expert insights on regulations, energy management, and sustainability delivered straight to your inbox.

Materiality: The First Step in ESG Management

The easiest way to think of materiality is as a relevancy filter for the issues that matter most to an organization. That particular information is considered “material” – or relevant – if it could influence the decision-making of stakeholders regarding the company. The exercise of determining what issues are material to your organization is called a materiality assessment.

This might sound like a great place to begin your whole ESG strategy, (and you’d be right) but it doesn’t always play out that way. Many organizational leaders decide to pursue specific ESG goals, often based on a choice of ESG reporting framework, without sitting down to figure out whether those goals are the most relevant ones for their company and their operations. This can lead to several less-than-ideal situations, like over-reporting, or ignoring the risks and opportunities that could make the biggest impact on your own company’s ESG performance.

In other words, if you don’t start with a materiality assessment, you’re letting other people who don’t know the specifics of your company determine what’s relevant for you. It makes more sense to take ownership of that yourself and conduct an assessment that captures the specific risks and opportunities for your business and sets you up for success.

That’s why, while the name itself wasn’t always used, materiality has long been a central part of a “management system” approach. For instance, ISO 14001, the international standard for environmental management systems, states that organizations need to determine the “internal” and “external” issues relevant to its environmental performance and determine which “aspects” of their operations have significant environmental “impacts.” Based on this materiality assessment, the organization then determines which goals, or objectives, make the most sense for them.

Materiality in Practice: Objectives, Targets and Programs

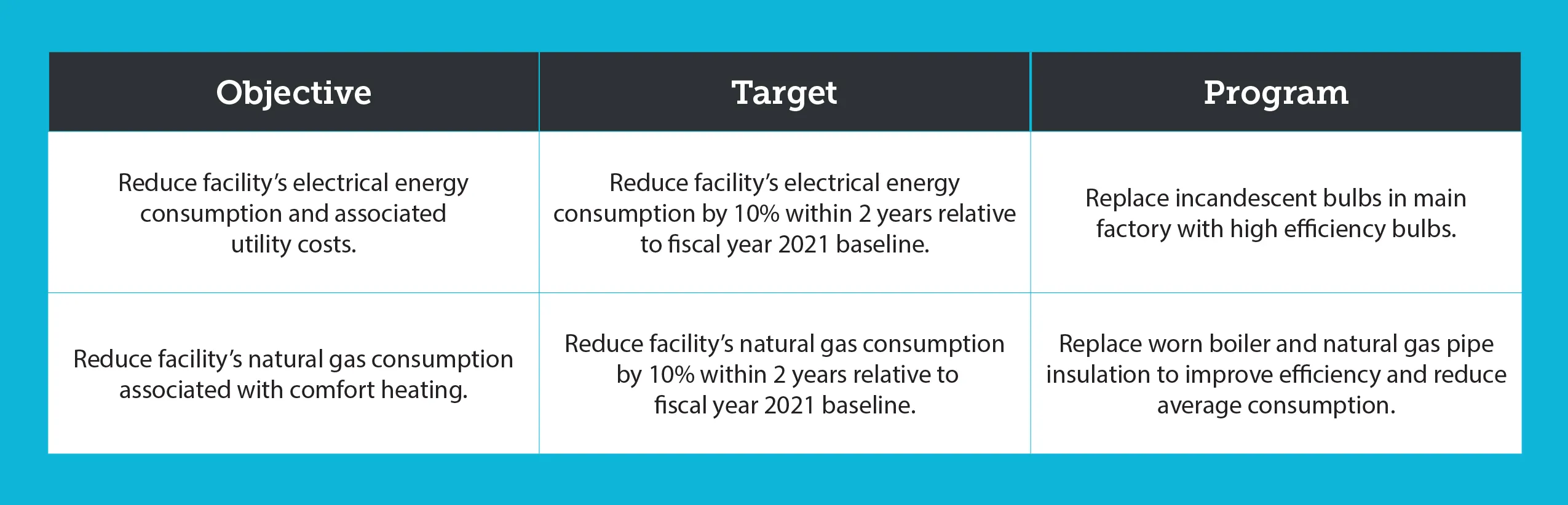

Let’s look at an example of how materiality can help an organization choose and manage solid ESG management objectives. In what follows, we’ll use the common way of thinking about objectives as defined by ISO 14001, in a system of “Objectives, Targets and Programs.”

Objectives are goals, stated generally, that you would like to meet in the future. In other words, when you’re writing an objective, even though you should already be thinking about how you’re going to measure and verify them, you’re not going to get that granular yet.

Targets are the point where granularity comes in. Setting targets involves determining specific verifiable measures to document that you’re meeting your objectives and meeting the chosen performance criteria.

Programs are the specific methods and strategies you’re going to use within your environmental management system to achieve your objectives and targets.

An organization selects its Objectives, Targets and Programs based on its assessment of material impacts. For example, suppose our facility annually uses a significant amount of electrical energy for processes, as well as a large quantity of natural gas for comfort heating. This might especially be true if it’s an older building with an outdated electrical system, or one that has aging boiler or pipe insulation. There are many reasons why we might consider this energy consumption “material,” but for now, let’s focus on an issue that internal stakeholders will widely recognize: Energy consumption comes with financial costs in the form of utility bills, and reduction of energy usage therefore represents an opportunity for cost savings.

We can see what some potential Objectives, Targets and Programs might look like for our facility in the table below.

So, to recap, we started with our materiality assessment, which showed us that our facility uses a large amount of electricity and natural gas. That helped us pick relevant objectives, and then figure out reasonable numerical targets to pursue, and plan programs to efficiently achieve those aims. It’s hard to imagine getting this level of focus and organization if you’re overlooking materiality.

What is Double Materiality?

So far, it might seem straightforward. It sounds simple enough to say that materiality is about relevance, until we start asking questions about how to determine relevance – i.e., about the context or framework we use to determine the relevant issues. Our example above shows one way of thinking about materiality – namely, in terms of financial benefits and costs. But another frame we could rightfully use in that example involves thinking about the impacts of our energy consumption on the world outside our company, such as in terms of depletion of fuel resources and emissions of associated air contaminants and greenhouse gases (GHGs).

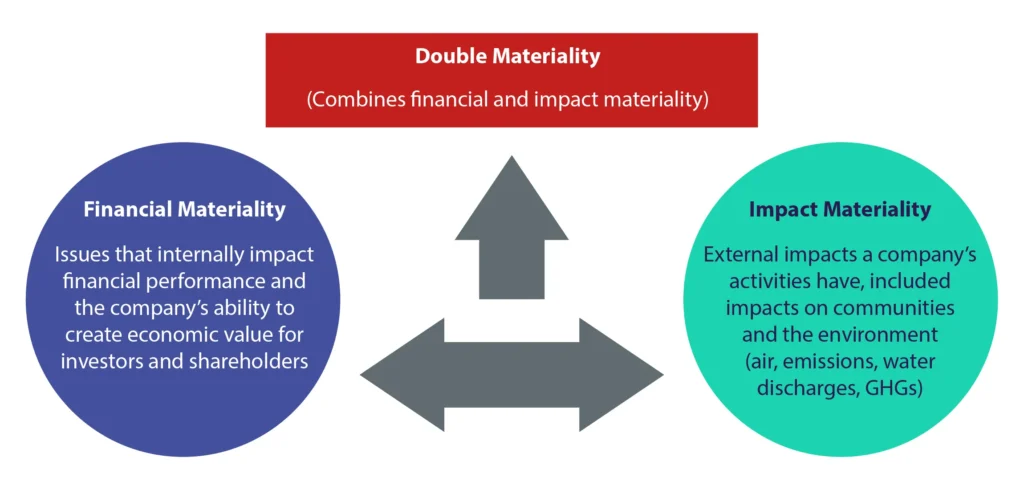

In ESG circles, the two main ways of thinking about that break down into financial materiality and impact materiality.

Financial materiality is about economic value-creation – it’s focused on the issues that internally impact a company’s financial performance and its ability to create economic value for investors and shareholders.

Impact materiality focuses on the external impacts an organization’s activities have, including impacts on communities and the environment. These would include the organization’s contributions to air and water pollution, for example, or its emissions of greenhouse gases (GHGs) that add to global climate risks.

These two types of materiality aren’t isolated from each other, because some issues create both internal financial risks and external impacts. For example, a company that has an uncontrolled release of a hazardous chemical would certainly create external impacts on the local community, potentially on organisms in water and soil, and might also be opening themselves up to regulatory violations and associated penalties, or financial losses from civil suits. And a company with a high intensity of GHG emissions may be contributing to climate risks, including severe weather events that can damage their facilities or disrupt supply chains.

The relevance and interconnectedness of both impact and financial materiality is the reason for the growing importance of the concept of double materiality, which combines both perspectives. The relationship among financial materiality, impact materiality and double materiality is shown in the figure below.

As Global Reporting Initiative (GRI), one of the premier standards-developing bodies in the world puts it:

“Double materiality is the union … of impact materiality and financial materiality. A sustainability matter meets therefore the criteria of double materiality if it is material from either the impact perspective or the financial perspective or both perspectives.”

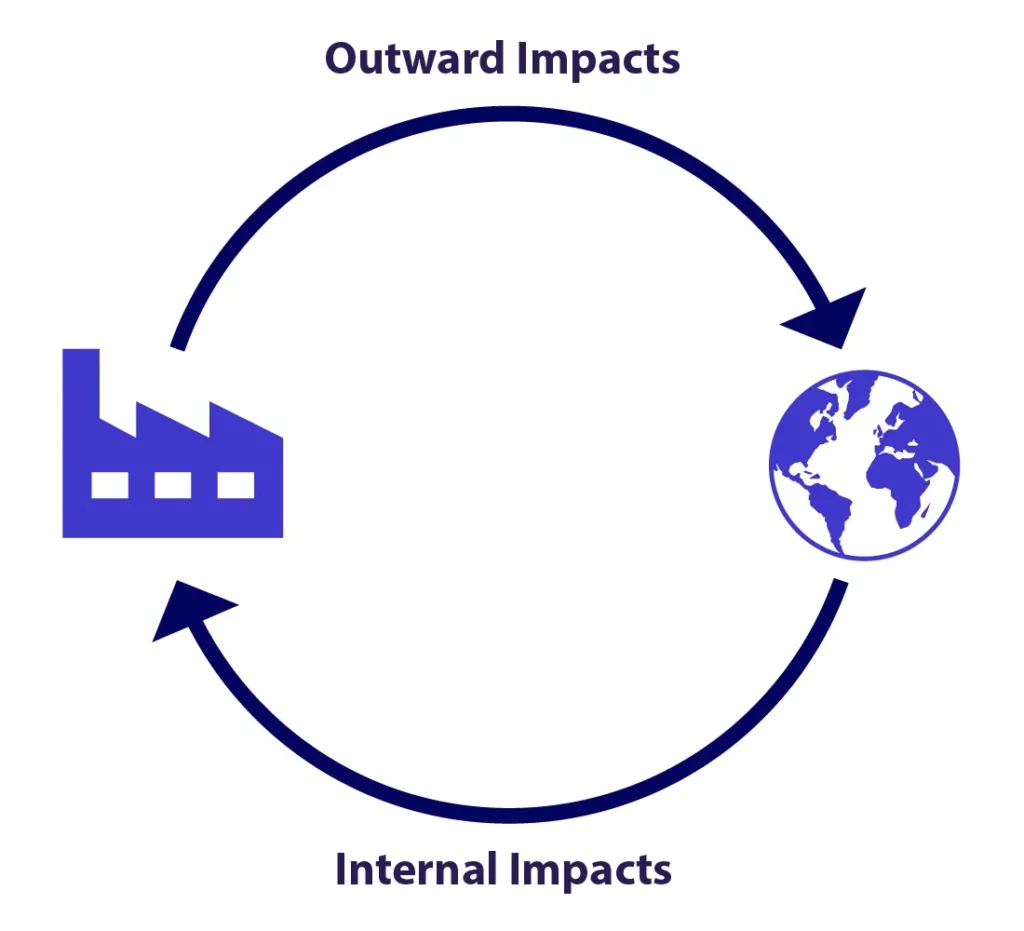

In other words, it’s about not only how sustainability impacts your own performance and position, but also about your company’s impact on wider sustainability issues. This dynamic interplay between internal impacts and outward impacts is shown in the figure below.

Some possible issues to include in a double materiality assessment include:

- How would external climate risks impact your financial performance?

- In what ways do your operations contribute to pollution of air, water, and land?

- How can you reduce all 3 scopes of GHG emissions?

A major challenge is that materiality is, by its very definition, context dependent. That means that materiality issues in ESG vary across sectors, and even across individual facilities. Company leadership needs to assess materiality based on the organization’s overall operating context, while also identifying the unique risks and opportunities for each of their operating locations.

Materiality and ESG Reporting Frameworks

One of the things that’s potentially confusing about the different ESG reporting frameworks is that some are based on “value-focused” reporting, or financial materiality, and others are based on the double materiality concept.

For example, the draft European Sustainability Reporting Standards (ESRS) recently published by the European Financial Reporting Advisory Group (EFRAG) would create mandatory disclosure requirements for tens of thousands of European companies based on a double materiality framework. In contrast, the two draft standards published by the International Sustainability Standards Board (ISSB) emphasize enterprise value-focused reporting, or financial materiality.

That doesn’t mean the approaches to materiality across frameworks won’t converge over time. There are reasons to think that might happen. For example, GRI emphasizes the importance of double materiality, and GRI works with both EFRAG and ISSB, and EFRAG has a longstanding advisory relationship with International Financial Reporting Standards (IFRS) Foundation, the parent organization of ISSB, as we discussed in a recent blog post.

This just shows that companies are going to need to be agile to meet the demands and expectations of evolving ESG reporting frameworks, and that will be easier if your tools are agile, too. Modern ESG software that simplifies materiality and double materiality assessments can provide just the support you need.

Looking for More Information on Materiality and Double Materiality?

If you’re looking for information about how materiality assessments function in the larger context of an EHS/ESG management system, download our new eBook on ISO 14001.

You may also want to check out our upcoming live webinar on ISO 14001, which will include an opportunity for a Q & A.

Register for “ISO 14001: Using the Standard to Improve Environmental Management”

Also, be sure to watch our recent webinar “What EHS Leaders May Have Missed: Important Updates During the Past Year” Our subject matter experts discuss major developments in the world of EHS/ESG over the last year, including SEC’s proposed ESG disclosure rule in the US, ISSB’s publication of two draft ESG standards, and EFRAG’s publication of its initial batch of ESG disclosure rules for European companies.

Watch “What EHS Leaders May Have Missed: Important Updates During the Past Year”

Check back on this blog space often to see future posts on ESG, including a forthcoming post on best practices for conducting materiality assessments.

Also, be sure to follow us on LinkedIn to make sure you’re always getting the latest updates about EHS/ESG!

Participate in our ESG Benchmarking Survey!

Our goal with this study is to compile feedback to better understand corporations’ ESG strategies, trends, and initiatives. To participate, answer this short survey. Please allow yourself one minute to complete it. Complete the ESG Benchmarking Survey now.

Let VelocityEHS Help!

The Materiality Assessment capabilities of our ESG Software, part of the VelocityEHS Accelerate® Platform, makes it easy for businesses like yours to conduct materiality assessments. You’ll quickly be able to set up surveys and collect data to help you identify the most important ESG risks and opportunities for your organization and prioritize your issues to enable a more strategic focus. By ensuring input from stakeholders on the most relevant aspects of your business, you’ll also build the engagement and transparency you need to achieve and maintain ESG maturity.

Ready to lean more? Contact us anytime to find out how our software helps you build an ESG program that works.