A

Agenda for Sustainable Development: A declaration by the UN Political Forum on Sustainable Development issued in 2015(opens in a new tab) that sets out the 17 Sustainable Development Goals and 169 associated targets to be achieved by the year 2030 in areas of critical importance for humanity and the planet.

Air Emissions: Gases and airborne particles which are put into the air or emitted by various sources. Common air emissions of concern include Criteria Air Pollutants(opens in a new tab), Hazardous Air Pollutants(opens in a new tab), and greenhouse gasses (GHGs)(opens in a new tab)

Anthropogenic: Of, relating to, or resulting from the impact or influence of human beings and human activity on nature and the environment. (See Climate Change)

Anti-Competitive Practices: Actions by an organization or its employees in collusion with others intended to limit or eliminate fair market competition. Often referred to as “Horizontal Conduct” these actions include entering into illegal or unethical agreements with competitors to such a degree that they are no longer acting independently, or when the collaboration gives the organizations the ability to wield market power together. Examples may include coordinating bids; creating market or output restrictions; fixing prices; imposing geographic quotas).

Anti-Trust and Monopoly Practice: Action of the organization that can result in barriers for entry to the sector, or another collusive action that prevents competition. Often referred to as “Single Firm Conduct”, examples of such actions can include abuse of market position, anti-competitive mergers, formation of cartels, price-fixing, unfair business practices, etc.

Back to top

B

Benchmark/Benchmarking: An objective data point that serves as a reference for companies internally to target ESG performance improvements; for peers or competitors to evaluate their own performance against similar organizations within their industry, and; for investors and other stakeholders to evaluate an organization’s performance against established standards and targets.

Biodiversity: Describes the variety of life on Earth. It can be used more specifically to refer to all of the species in one region or ecosystem. Biodiversity refers to every living thing, including plants, bacteria, animals, and humans. High levels of biodiversity provide the value of maintaining a high level of variation in genomes and ecosystems—maximizing their adaptability and resilience in the face of ecological change, disease and other selective forces.

Biogenic Carbon Dioxide (CO2) Emission: Emission of CO2 from the combustion or biodegradation of biomass

Brownfield: A property or tract of land for which expansion, re-development or otherwise use may be deemed unsafe due to the presence of hazardous substances, pollutants, wastes or other contaminants.

Back to top

C

Cap and Trade: An cooperative economic mechanism or framework intended to reduce GHG and other air emissions by establishing an enforceable, science-based limit (cap) on total emissions from all emitters participating in the framework, allocating emissions allowances (see carbon credit) for individual emitters/facilities based on historical emissions data, and creating a trading scheme where emitters who emit below their allowance may sell unused emissions allowances/credits to other emitters who exceed their allowances.

Carbon Credit: A generic term for any tradable certificate or permit that allows the holder (i.e. a company) participating in an emissions trading scheme to emit a specified unit of CO2 equivalents. Carbon credits are typically issued by a regulating agency which establishes a carbon credit ‘allowance’ for organizations based on historical emissions and industry averages. Unused credits can then be traded and sold between credit holders. For example, if one credit holder has emitted CO2 equivalents below their allowance, they may sell unused credit(s) to another credit holder who requires more credits beyond their allowance or face potential fees and penalties. The carbon credit trading scheme has the goal of incentivizing emissions reductions by providing real financial benefits to emissions reductions and imposing added costs for exceeding emissions allowances.

Carbon Dioxide Equivalent (CO2e): A unit to express the impact of a greenhouse gas (GHG), signified as the amount of CO2 with an equivalent impact on global warming. The amount of CO2 is commonly expressed as tonnes, also known as metric tons, equivalent to 1,000kg each.

Carbon Footprint: The amount of carbon dioxide (CO2) emissions associated with all the activities of a person or other entity (e.g., building, corporation, country, etc.). It includes direct emissions, such as those that result from fossil-fuel combustion in manufacturing, heating, and transportation, as well as emissions required to produce the electricity associated with goods and services consumed. In addition, the carbon footprint concept also often includes the emissions of other greenhouse gases, such as methane, nitrous oxide, or chlorofluorocarbons (CFCs).

Carbon Intensity: An organization’s total volume of carbon emissions for a specific process, facility, or organization as a whole, (measured in CO2e) divided by total units of production or total economic activity. Carbon intensity is an important ESG metric for evaluating the current efficiency of the organization and a targeted benchmark for future carbon emissions reductions.

Carbon Pricing: Carbon pricing is a strategy to reduce levels of greenhouse gas (GHG) emissions by associating economic costs with GHG emission levels, to incentivize companies to reduce their combustion of fossil fuels (coal, oil and gas) and reduce their GHG emissions. Carbon pricing is emerging as an accepted government policy strategy and involves either a carbon tax (a direct tax levied based on emissions) or carbon emission trading (CAT), aka “cap and trade.”

Carbon Neutral: For a project or entity to be carbon neutral, any CO2 released into the atmosphere is balanced by an equivalent amount being removed. This may be achieved through financing or otherwise supporting efforts to remove CO2 from the atmosphere, such as the development of renewable energy projects or planting trees or using carbon credits or carbon trading schemes. An entity may therefore be ‘carbon neutral’ without reducing its emissions.

Carbon Offset: A carbon offset is a mechanism by which an entity compensates for greenhouse gas (GHG) emissions by paying for an equivalent GHG reduction, such as the development of renewable energy projects or planting trees.

CDP (formerly Carbon Disclosure Project): The CDP (formerly the Carbon Disclosure Project) is an international non-profit organization based in the United Kingdom, Japan, India, China, Germany, and the United States of America that supports companies and municipalities in their efforts to measure and manage their environmental risks and opportunities, including those related to climate change, water security and deforestation.

Circular Economy (CE): The concept of the circular economy is a central, modern approach to sustainability and ESG. In a linear economy, companies use raw materials to produce goods that are assumed to reach an “end of life.” They become waste, and companies continually just produce new goods to replace them. In a CE, by contrast, the goal is to reuse, refurbish and recycle to create a closed loop system to the highest degree possible.

Climate Change: The long-term change in the average weather patterns that characterize Earth’s local, regional, and global climates. These changes have a broad range of observed effects that are synonymous with the term. Within the scope of ESG, we are focused on the anthropogenic effects of climate change.

Climate Risks and Opportunities: The phrase “climate risks and opportunities” is common in the ESG world and refers to both the urgency to avoid negative consequences associated with climate change, and the opportunities available for businesses who shift their business model to provide sustainable products and services increasingly demanded by stakeholders. For example, climate risks would include risks of contributing to global greenhouse gas emissions that drive additional climate change, and of risks to business continuity posed by extreme weather events that are becoming more frequent due to climate change. Opportunities would include the manufacturing of products that replace more emissions-intensive products and services and capturing the growing market demand for such products.

Climate Transition Plan: A climate transition plan is a formal written plan describing how an organization will pivot its existing assets, operations, and business model to account for climate risks and opportunities, and to align with specific climate recommendations and science-based targets, such as reaching net-zero by 2050 to mitigate climate change.

Conscious Consumerism: Consumers actively seeking out and purchasing products and services they perceive to be produced responsibly.

Conscious Capitalism: A form of capitalism that seeks to benefit people and the environment (see triple bottom line).

Corporate Social Responsibility (CSR): A management concept that integrates social and environmental concerns into business operations and stakeholder relationships. CSR is generally understood as the set of organizational values through which a company achieves a balance of economic/financial, environmental and social imperatives (See Triple-Bottom-Line) while also addressing the expectations and interests of stakeholders.

Corporate Sustainability Reporting Directive (CSRD): The Corporate Sustainability Reporting Directive (CSRD)(opens in a new tab) is a binding agreement issued by the European Council in 2022 that amends the 2014 non-financial reporting directive to address shortcomings in the disclosure of non-financial information, which was of insufficient quality to allow it to be properly taken into account by investors. CSRD introduces more detailed reporting requirements and ensures that large companies are required to report on sustainability issues such as environmental rights, social rights, human rights and governance factors. The CSRD also introduces a certification requirement for sustainability reporting as well as improved accessibility of information, by requiring its publication in a dedicated section of company management reports. The European Financial Reporting Advisory Group (EFRAG) is responsible for establishing European standards of compliance with the CSRD.

Corporate Governance: The policies, practices, and processes used to direct and manage a company. The main force influencing corporate governance is a company’s board of directors, although the board is strongly influenced by stakeholder interests and priorities.

Cradle-to-Grave: The concept that hazardous substances and wastes which have long-term or permanent harmful effects to human health and the environment should be managed in a manner that minimizes or eliminates those effects from the point of origin to final disposal, and at each point of transfer or storage throughout the management life cycle.

Back to top

D

Divestment: The act of dissociating or selling assets and securities due to behavior not aligned with ESG values, or a way to display strong commitment to ESG and responsible investing practices.

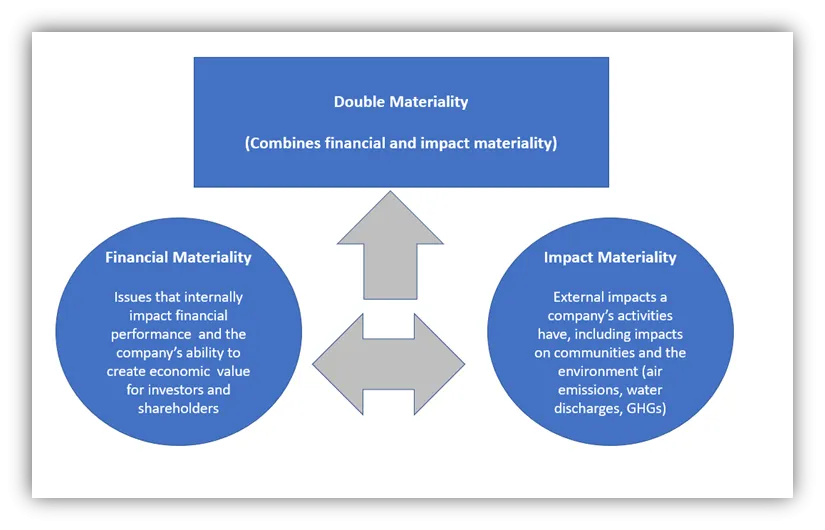

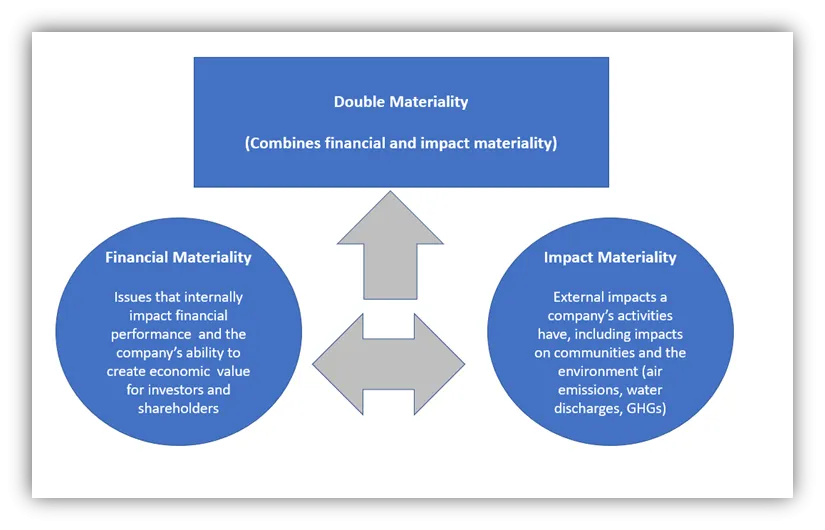

Double Materiality: Double materiality is a perspective for determining the ESG issues that matter most to an organization that recognizes the relevance and interconnectedness of both Impact and Financial Materiality. Put another way, double materiality is the union of impact and financial materiality; a company would consider an ESG issue material if they determine it to be material from either an impact or financial materiality perspective. The draft European Sustainability Reporting Standards (ESRS) recently published by the European Financial Reporting Advisory Group (EFRAG) would create mandatory disclosure requirements for tens of thousands of European companies based on a double materiality framework.

Dow Jones Sustainability Indices (DJSI): A group of corporate listings provided for sustainability-focused investors to identify companies who have demonstrated sufficiently sustainable business practices and ESG performance. DJSI indices serve as benchmarks for investors who integrate sustainability considerations into their portfolios, and also provide an effective engagement platform for investors who wish to encourage companies to improve their corporate sustainability practices.

Dynamic Materiality: Dynamic Materiality recognizes that what is considered material may change over time, and therefore takes a forward-looking, adaptive approach to reprioritizing ESG topics to allow for more regular action on newly identified risks.

Back to top

E

EcoVadis: A third-party sustainability consultancy and ratings firm which works with businesses to assess ESG risks and develop strategies and policies for organizations to achieve greater levels of ESG performance. Visit https://ecovadis.com/about-us/(opens in a new tab)

Emissions Inventory: A measure of the total greenhouse gas emissions produced by an individual, group, or company.

Energy Star: Energy Star(opens in a new tab) is program run by the U.S. Environmental Protection Agency and the U.S. Department of Energy. According to the program’s official website, Energy Star is intended to provide simple, credible, and unbiased information that consumers and businesses rely on to make well-informed decisions regarding a company or product’s energy efficiency.

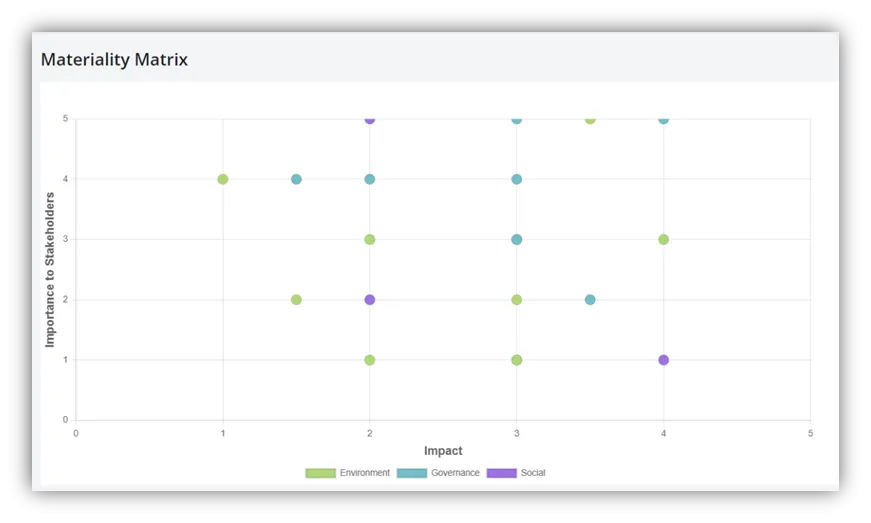

Environmental Aspects & Impacts: An “aspects and impacts” analysis is an exercise in identifying the characteristics (aspects) of an organization’s operations that create significant environmental issues (impacts) such as waste generation, water discharges, or air emissions, including GHG emissions. For instance, ISO 14001, the international standard for environmental management systems, states that organizations need to determine the “internal” and “external” issues relevant to its environmental performance and determine which “aspects” of their operations have significant environmental “impacts.” The process of conducting an aspects & impacts analysis therefore involves many of the same considerations as doing a Materiality Assessment and should involve the same stakeholders.

Environmental Management System (EMS): According to ISO 14001, the international standard for environmental management, an environmental management system is a “set of interrelated or interacting elements of an organization to establish policies and objectives,” and includes “the organization’s structure, roles and responsibilities, planning and operation, performance evaluation and improvement.” A simple way to think of an EMS is as “people, places, and programs.” It consists of all the people who play roles in your EMS, including employees as well as external stakeholders like contractors and regulators, the facilities involved in your operations, and the specific environmental programs and policies for your organization. An important thing to remember is therefore that EMSs are as unique as the organizations developing and using them. They’re not “one size fits all,” and no one can sell you an EMS. Tools such as good EHS & ESG software can help you manage an EMS but are not the EMS itself.

Environmental, Social and Governance (ESG): ESG is an acronym for a business management approach that actively pursues excellence across three core areas of performance: environmental, social and governance. Performance in these core areas is evaluated using ESG metrics established under various ESG reporting standards and frameworks, and this data is heavily relied upon by sustainability-focused investors to evaluate and select companies and other investments for their portfolios. Examples of what ESG factors cover vary but they can include climate change, worker health and safety, DEI, human rights, labor rights, corporate ethics, business transparency and protecting the interests of shareholders.

EPA Waste Reduction Model (WARM): EPA’s WARM(opens in a new tab) is intended to show generators of hazardous waste the connection between better waste management practices and reduction of associated greenhouse gas (GHG) emissions. The model provides high-level estimates of potential greenhouse gas (GHG) emissions reductions, energy savings, and economic impacts from several different waste management practices. Waste management practices considered under WARM include source reduction, recycling, anaerobic digestion, combustion, composting and landfilling. Companies pursuing ESG maturity that generate significant volumes of hazardous waste would find WARM potentially useful for reducing their GHG footprint.

Ergonomics: The process of designing jobs and workstations to fit the worker, with the goal of reducing or eliminating risk for musculoskeletal disorders (MSDs) and other ergonomics-related injuries, and maximizing the number of workers who are able to safely perform a given job.

ESG Audit: Objective testing and verification of an organization’s ESG policies, systems, performance claims and other ESG program aspects. ESG audits are typically performed by a third-party auditor or consultancy that is independent of that organization in order to establish an impartial assessment of the organization’s ESG management and provide confidence for investors and other stakeholders in their decision-making processes.

ESG Disclosure: Reporting of environmental, social, and corporate governance data for the purpose of providing stakeholders with information on a company’s ESG performance and activities. ESG disclosure is the primary means of communicating to stakeholders that the company is meeting ESG targets and goals, and that the company’s commitment to ESG is genuine and not engaging in greenwashing. ESG disclosure is often performed in alignment with one or more ESG standards or reporting frameworks, and is a primary source of data for investors, supply chain partners and other stakeholders’ decision-making processes.

ESG Benchmarking: ESG benchmarking is a process of assessing some aspect of an organization’s ESG performance against the performance of comparable peers. For example, if you’re evaluating the energy efficiency of a facility, you’d want to compare it against the energy efficiency of other buildings with similar size, location, and asset type (i.e., residential, office building, retail, etc.). Benchmarking can play an important role in understanding your ESG performance and identifying areas for improvement.

ESG Integration: A process that combines the organization’s environmental, social and governance risks and priorities together with the typical financial and operational risks and goals of the business, and considers the effects and impacts that these risks and goals have on the business in a holistic fashion.

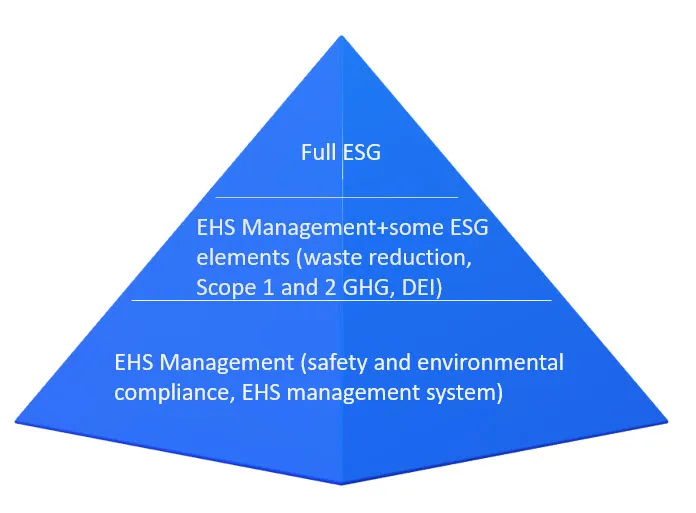

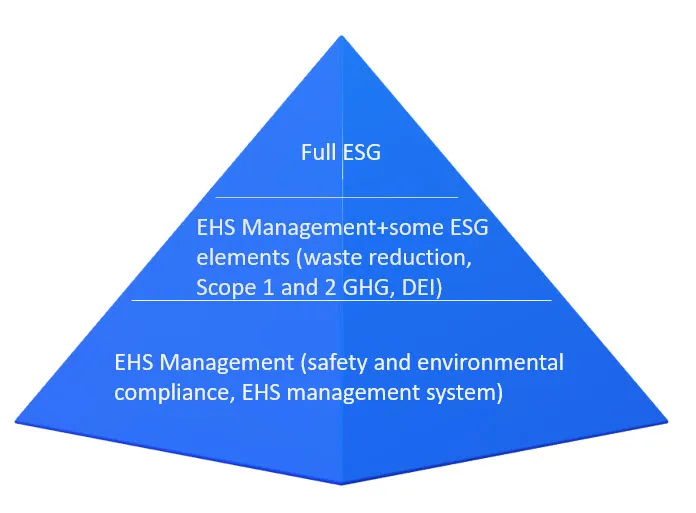

ESG Pyramid: The ESG pyramid is a visual representation of the stages in ESG maturity, loosely based on Abraham Maslow’s pyramid depicting the hierarchy of needs. The pyramid, shown below, conveys the idea that good EHS management is the foundation for achieving and maintaining ESG maturity. Organizations should consider using tools, including cloud-based software, that help with the full range of their EHS & ESG tasks to ensure better continuity of management practices and a firmer foundation om which to build mature ESG programs.

ESG Ratings: A measurable way to gain an understanding of a company’s performance and long-term commitment to environmental, social, governance (ESG). These ratings can be derived from evaluation criteria set forth in various ESG reporting standards and frameworks, or by third-party sustainability/ESG ratings organizations. These ratings are commonly relied on by organizations internally to benchmark their own performance and formulate improvements in ESG performance, and by sustainability-focused investors as a basis for evaluating risk and investment potential.

ESG Strategy: The term “ESG strategy” describes the process of an organization establishing primary ESG goals, measurable targets, and plans for achieving those goals. Ideally, this process would follow completion of a Materiality Assessment to identify the most important ESG issues for the organization and help ensure the company’s efforts are focused on the right things. A system of Objectives, Targets and Programs is one tool organizations can use as part of their ESG strategy.

Ethical Investing: Choosing investments that avoid companies who produce or deal in products and services that may be considered harmful or misaligned with sustainable business practices and values.

European Financial Reporting Advisory Group (EFRAG): EFRAG is a private organization founded by request and with the encouragement of the European Commission in 2001 to provide technical expertise and guidance on financial and accounting matters. In that capacity, they worked closely with the International Financial Reporting Standards (IFRS ®) Foundation, who themselves had recently formed in 2000.

Through its advisory relationship with IFRS, EFRAG influences the International Accounting Standards Board (IASB), a group operating under the authority of IFRS which develops and approves its parent organization’s accounting and financial standards. For example, EFRAG is a member of the European delegation to the IASB Accounting Standards Advisory Forum (ASAF), and the CEO of EFRAG is a member of the IFRS Advisory Council.

In 2022, EFRAG published a number of draft standards that would require tens of thousands of European companies to provide disclosures in various areas of ESG, including GHG emissions, how the organization considers climate risks and opportunities, air and water pollution, and workers in the value chain.

European Green Deal: The European Union’s (EU) Green Deal(opens in a new tab) is the EU’s stated growth strategy to transition the EU economy to a sustainable economic model. It sets out the goal of making the EU climate neutral by 2050 by reshaping the EU economy in the areas of climate impacts, energy, sustainable industry, building efficiency, transport, pollution, agriculture, biodiversity, research and development, and economic trade.

Back to top

F

Financial Materiality: Financial materiality is one perspective for determining the ESG issues that matter most to an organization. It uses the lens of economic value-creation – it’s focused on the issues that internally impact a company’s financial performance and its ability to create economic value for investors and shareholders. This is the definition of materiality adopted by the International Sustainability Standards Board (ISSB), an organization formed by its parent entity, the International Financial Reporting Standards (IFRS) Foundation, in late 2021.

Back to top

G

GHG Protocol: The GHG Protocol is a standards development body that establishes comprehensive global standardized frameworks to measure and manage greenhouse gas (GHG) emissions from private and public sector operations, value chains and mitigation actions. The GHG Protocol issued the first edition of its first standard, the Corporate Accounting and Reporting Standard, in 2001 and revised it in 2004. Over the years, the GHG Protocol has also published other standards related to various aspects of GHG accounting.

Green Bond: A green bond is a bond (i.e., a fixed income financial asset) that is used to fund projects that have positive impacts on the environment or climate.

Green Chemistry: Green chemistry is the design of chemical products and processes that reduce or eliminate the use or generation of hazardous substances. Green chemistry applies across the life cycle of a chemical product, including its design, manufacture, use, and ultimate disposal.

Greenhouse Gas (GHG): A GHG is a gas that absorbs and emits radiant energy within the thermal infrared range, causing the greenhouse effect. The primary greenhouse gases in Earth’s atmosphere are water vapor (H2O), carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), and ozone (O3). Because of the scientifically established role of GHGs in causing climate risks, all major ESG disclosure frameworks involve tracking and reporting GHG emissions.

Green Taxonomy: Also known as the EU Taxonomy(opens in a new tab), is a classification system which establishes a list of environmentally sustainable economic activities under the European Green Deal. The Green Taxonomy gives companies, investors, policymakers, and other stakeholders with standardized definitions for which economic activities can be considered environmentally sustainable. The intended effect is to provide certainty for stakeholders in evaluating ESG performance of organizations while helping those organizations to benchmark and improve their own performance more effectively.

Greenwashing: “Greenwashing” is a general term referring to efforts by organizations to frame themselves as having higher ESG maturity than they have. Greenwashing can come in several forms, including simple use of rhetoric or marketing claims not backed up by actions, “creative accounting” practices that make ESG initiatives seem more successful than warranted, or “sleight of hand” to, for example, present themselves as reducing GHG emissions when they’ve really just shifted their emissions from Scope 1 to Scope 2 or Scope 3 emissions. Concerns about greenwashing are one of the driving forces behind the push for better and more consistent ESG metrics, which has resulted in the formation of the International Sustainability Standards Board (ISSB) and the publication of its first draft standards.

GRESB (formerly Global Real Estate Sustainability Benchmark): GRESB is an organization established in 2009 that provides standardized and validated ESG data from the real estate sector to investors and capital markets. Companies in the real estate and property management sectors frequently use GRESB data for ESG Benchmarking to assess the sustainability performance of their global real estate and infrastructure investments.

Back to top

H

Human Capital: “Human capital” is a common term referring to the economic and organizational value of the workforce’s experience, skills, and contributions to success of the company. The term generally includes assets like education, training, intelligence, skills, health, and engagement and participation in company initiatives, including EHS & ESG programs. Management of human capital is an important part of ESG maturity, and should include considerations of psychosocial risks, Diversity Equity and Inclusion (DEI), and general equity in compensation and career opportunities.

Back to top

I

IFRS Foundation: The IFRS Foundation(opens in a new tab) is a not-for-profit, public interest organization established to develop high-quality, understandable, enforceable and globally accepted accounting and sustainability disclosure standards.

Impact Materiality: Impact materiality is a perspective for determining the ESG issues that matter most to an organization. Impact materiality focuses on the external impacts an organization’s activities have, including impacts on communities and the environment. According to the European Financial Reporting Advisory Group (EFRAG), “a sustainability matter is material from an impact perspective if it is connected to actual or potential significant impacts by the undertaking on people or the environment over the short-, medium- or long-term. This includes impacts directly caused or contributed to by the undertaking in its own operations, products or services and impacts which are otherwise directly linked to the undertaking’s upstream and downstream value chain, and not limited to contractual relationships.”

Intergovernmental Panel on Climate Change (IPCC): The IPCC is an intergovernmental body of the United Nations (UN) headquartered in Geneva, Switzerland. IPCC is responsible for advancing knowledge on climate change and its human sources, including industrial activities. The World Meteorological Organization (WMO) and the United Nations Environment Programme (UNEP) established IPCC in 1988.

Integrated Reporting: An approach to corporate reporting that integrates financial information and non-financial (e.g. ESG disclosure) information into a single document to show how a company is performing.

International Sustainability Standards Board (ISSB): The ISSB(opens in a new tab) is a group within and overseen by the IFRS which is tasked with developing a comprehensive and standardized global base of sustainability-related disclosure standards to provide investors and other stakeholders with information about companies’ ESG risks and opportunities to help them make informed and reliable data-driven decisions.

ISO 14001: ISO 14001 is an international standard developed by the International Organization for Standardization (ISO) that models best practices for an environmental management system (EMS). ISO published the first edition of 14001 in 1996 and revised the standard in 2004 and 2015. The most recent (2015) edition reflects the increasing consensus about the importance of considering all stakeholders (both internal and external to the organization) and the larger context of the company’s operations, both of which are integral considerations for ESG management.

An organization can choose to certify to ISO 14001, in which case they will need to undergo audits by an accredited third-party organization to confirm that they are aligned with the framework of 14001 as well as in alignment with their own programs and policies in their EMS. ISO 14001 is a useful framework for companies pursuing ESG maturity, because it helps them develop good processes to complete basic environmental management tasks and maintain regulatory compliance while adding sustainability initiatives. EHS management is the base of the ESG Pyramid, and a necessary foundation for ESG maturity.

ISO 26000: ISO 26000:2010 is a non-binding guidance standard developed by the International Standards Organization (ISO) that is designed to clarify and standardize definitions and criteria of ‘social responsibility’. This guidance helps businesses and organizations translate often abstract principles of social responsibility into concrete actions and best practices to improve social responsibility. ISO 26000 is increasingly accepted as viable criteria for assessing an organization’s commitment to social sustainability and ESG performance.

ISO 45001: ISO 45001 is an international standard published by the International Organization for Standardization (ISO) in 2018 that models best practices for occupational health & safety (OH & S) management systems (SMSs). Compared with previous standards for OH &S management like OHSAS 18001, 45001 has a greater emphasis on identification and consideration of internal and external stakeholders, and on “consultation and participation” of all workers, including non-managerial workers. These characteristics align 45001 with the growing consensus of global OH & S subject matter experts about the importance of engagement and worker buy-in to safety management programs, and the emphasis on stakeholders’ points toward ESG Strategies.

An organization can choose to certify to ISO 45001, in which case they will need to undergo audits by an accredited third-party organization to confirm that they are aligned with the framework of 45001 as well as in alignment with their own programs and policies in their SMS. Because 45001 takes a broad view of the organization and its context, and recognizes the need to address a wide range of risks and opportunities, it provides a good framework for addressing the ”S” in ESG and pursuing ESG maturity.

ISO 45003: ISO 45003, titled “Occupational health and safety management — Psychological health and safety at work — Guidelines for managing psychosocial risks” is a guidance standard published by the International Organization for Standardization (ISO) in 2021. The standard is not intended to be used for certification purposes in itself but is intended to supplement and work in tandem with ISO 45001 to help an organization manage Psychosocial Risks within its OH &S management system. ISO’s development and intended use of the standard reflects the growing consensus among EHS & ESG experts that psychosocial risks management depends on traditional safety management.

Back to top

J

Back to top